Every importer and exporter knows the frustration of sudden tariff changes. One day, your costs are predictable, the next day, a new regulation changes everything. Missing these updates can mean delayed shipments, higher expenses, and even compliance penalties. That is why businesses are turning to a tariff tracking tool that gives instant alerts.

This kind of tool goes beyond spreadsheets. It gives you a real-time look at what is changing in trade regulations. Instead of scrambling when customs duty rules shift, you can prepare with confidence.

What is a tariff tracking tool?

A tariff tracking tool is software that monitors global trade rules. It checks updates on customs duties, tariff schedules, and compliance requirements. When a government issues new regulations, the tool notifies you immediately.

The idea is simple. Instead of searching for updates yourself, the system delivers them to you. This saves hours of manual work and reduces the risk of missing critical changes.

Benefits of using a tariff tracking tool

Real-time trade compliance

Manual research cannot keep up with the speed of regulatory updates. A tariff tracking tool brings real-time trade compliance. That means you receive updates as soon as they are available. You can review, adapt, and act quickly without waiting for secondary reports.

Customs duty monitoring made simple.

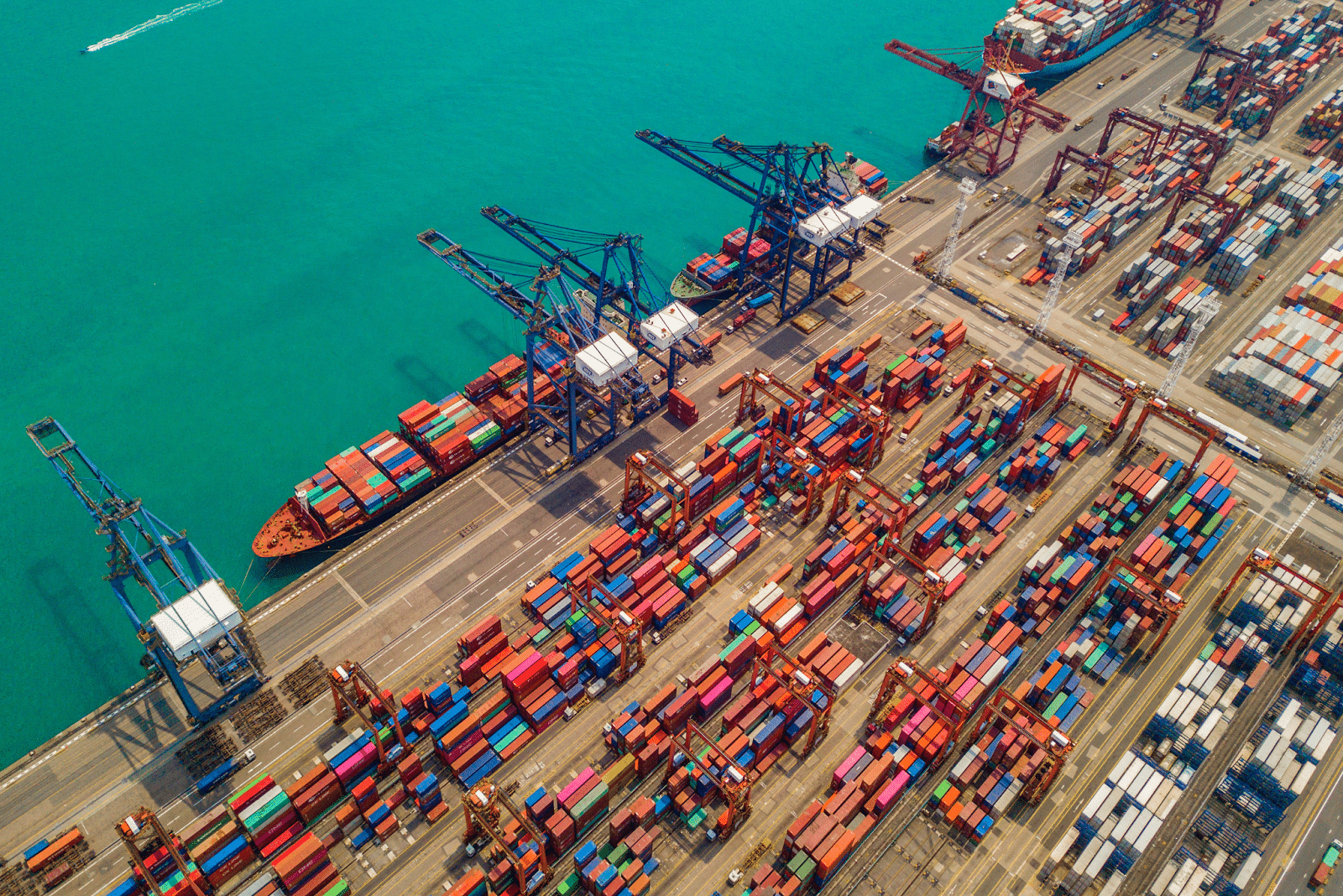

With traditional methods, checking duty rates across multiple countries is slow. A tool designed for customs duty monitoring provides clear data in one place. You can see duty rates, rules of origin, and tariff adjustments without opening dozens of websites.

Integration with import export software

Modern trade management is already digital. Linking a tariff tracking tool with import export software creates a single workflow. Shipping documents, duty calculations, and compliance alerts all appear in one dashboard.

Reducing the risk of penalties

Late or missed compliance can bring heavy fines. Automated monitoring reduces that risk. Instead of depending on memory or manual checks, you have a system designed to keep you compliant.

Visual Guide to Tariff Tracking Benefits

How it compares to manual tracking

Aspect | Manual Tracking | Tariff Tracking Tool |

Speed | Hours of research | Instant notifications |

Accuracy | Risk of missed updates | Automated data collection |

Cost | Higher staff time | Lower long-term costs |

Scope | Limited countries at once | Global monitoring |

Reliability | Human error possible | System alerts with history |

Who benefits the most

- Importers need to monitor changing duty rates on consumer goods.

- Exporters sending products to multiple markets at once

- Freight forwarders handling compliance for many clients

- Small businesses with limited compliance staff

No matter the company size, access to a tool that delivers trade regulation updates in real time makes operations smoother.

Why instant tariff alerts change everything

Think about the last time a tariff changed overnight. Did your costs jump unexpectedly? A smart tool avoids that chaos. With instant tariff alerts, you can adjust pricing, prepare new paperwork, or even shift supply chain strategies before your goods reach customs.

This means fewer surprises, better margins, and stronger compliance.

How to choose the right tariff tracking tool

- When selecting a system, look for these features:

- Real-time trade compliance updates

- Customs duty monitoring across regions

- Integration with import export software

- Easy-to-read dashboards and reports

- Support team that answers questions quickly

Internal and outbound connections

Trade does not exist in isolation. Reliable tariff tracking tools often reference government trade portals and official customs sites. Staying linked to these sources ensures updates are not only fast but also accurate. For deeper insights into trade regulations, you can explore global resources like the World Trade Organization and official customs authority websites.

Why this matters for the future of global trade

Tariff changes are not slowing down. Political shifts, trade disputes, and economic strategies make duties unpredictable. Businesses that depend on manual processes will fall behind. Those who adopt a smart tariff tracking tool will have the agility to move with the market.

Real-time trade compliance is no longer optional. It is the standard for businesses that want stability and growth.

Ready to Simplify Tariff Tracking?

At Importivity, we believe businesses should spend less time worrying about tariff updates and more time growing. With our smart tariff tracking tool and expert services, you can stay compliant, cut costs, and plan with confidence.

Explore Importivity today and see how easy global trade compliance can be.

frequently asked questions

What is a tariff tracking tool?

It is software that monitors customs duty and trade regulation updates in real time, helping importers and exporters stay compliant.

How does it support real-time trade compliance?

It delivers instant updates when trade authorities release new tariffs or customs duty changes.

Can it integrate with import export software?

Yes, many tariff tracking tools link with import export software, creating a unified workflow for compliance and documentation.

Who should use a tariff tracking tool?

Importers, exporters, freight forwarders, and small businesses dealing with international shipments benefit the most.

Why is customs duty monitoring important?

Because missed updates can cause delays, fines, and unexpected costs. Monitoring duties ensure smooth trade operations.