Every importer knows the feeling of watching margins shrink as customs duties climb higher than expected. That is where tariff consulting comes in. Instead of treating customs as a black box, businesses now look at it as a place to protect margins and find savings. The right approach makes customs duty consulting services more than compliance. It turns them into a strategy for better pricing, stronger forecasting, and fewer surprises in your supply chain.

At Importivity, we see companies that once treated duties as a sunk cost now using smart import export tariff management to create room for growth. The shift is real. Businesses are asking new questions. How do we avoid paying more than we should? How do we manage trade compliance across different markets? Most importantly, how do we turn complexity into clarity?

From Complexity to Strategy with Tariff Consulting

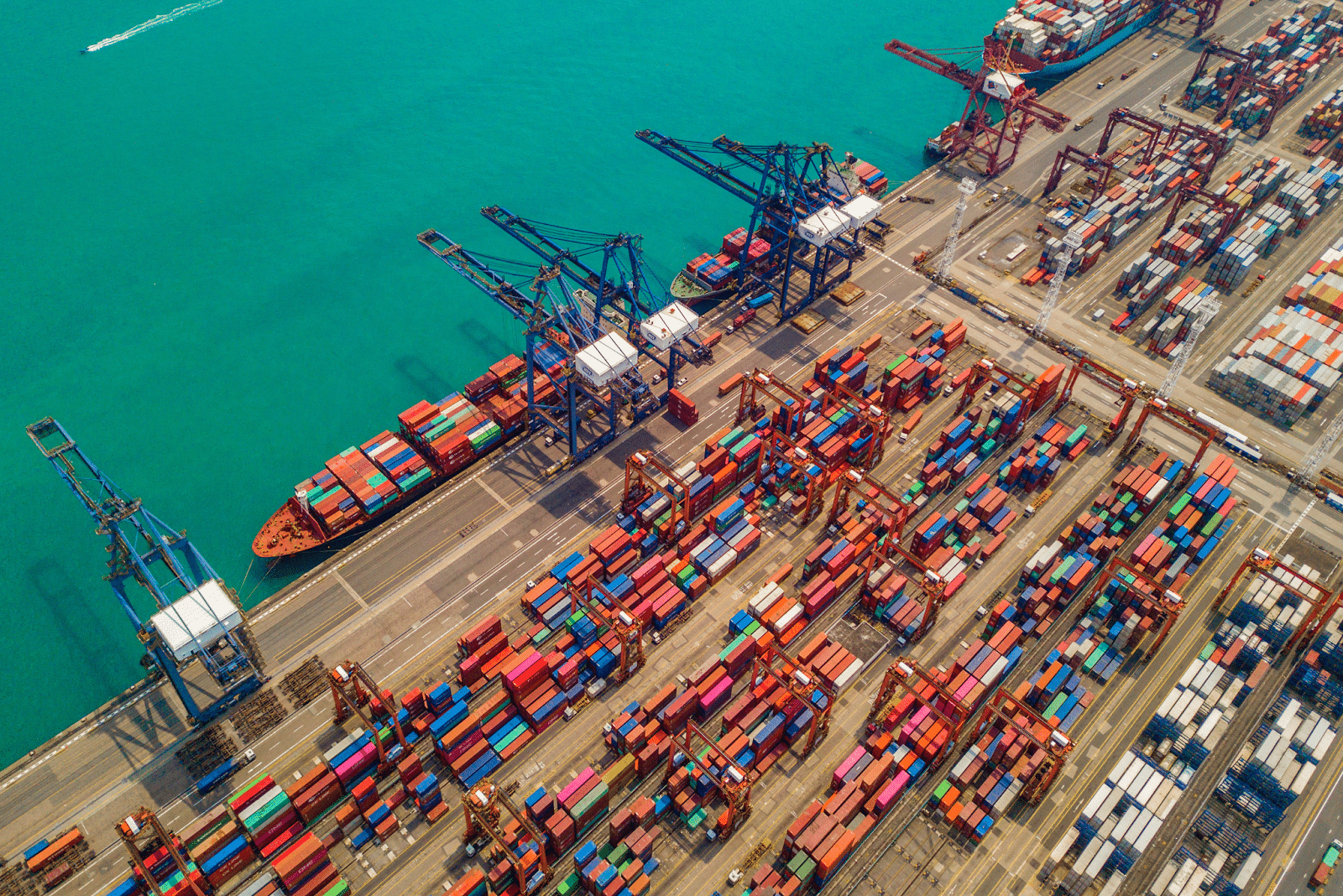

Global trade is full of moving parts. Every shipment carries codes, rules, and exemptions. A small error can mean weeks of delay or thousands in penalties. Without global trade compliance solutions, companies risk compliance failures or missed savings opportunities.

That is why tariff consulting is not just about paperwork. It is about translating dense tariff schedules into a playbook that protects your bottom line.

For example, a client who was paying duties on a product misclassified under the wrong tariff code found out that a correction reduced their cost by 14 percent. What looked like a minor code issue turned into meaningful margin protection.

Why are customs duty consulting services growing

The demand for customs duty consulting services has grown for three clear reasons:

- Constant rule changes – Governments revise tariff codes and trade agreements every year. Staying updated requires expertise.

- Rising compliance costs – The cost of errors now extends beyond money. Delays affect brand reputation and customer trust.

- Global supply chains – Multi-country sourcing means a single mistake can multiply across markets.

The companies that thrive are the ones that treat tariff consulting as part of their financial strategy, not just an administrative task.

Reduce costs with tariff strategies

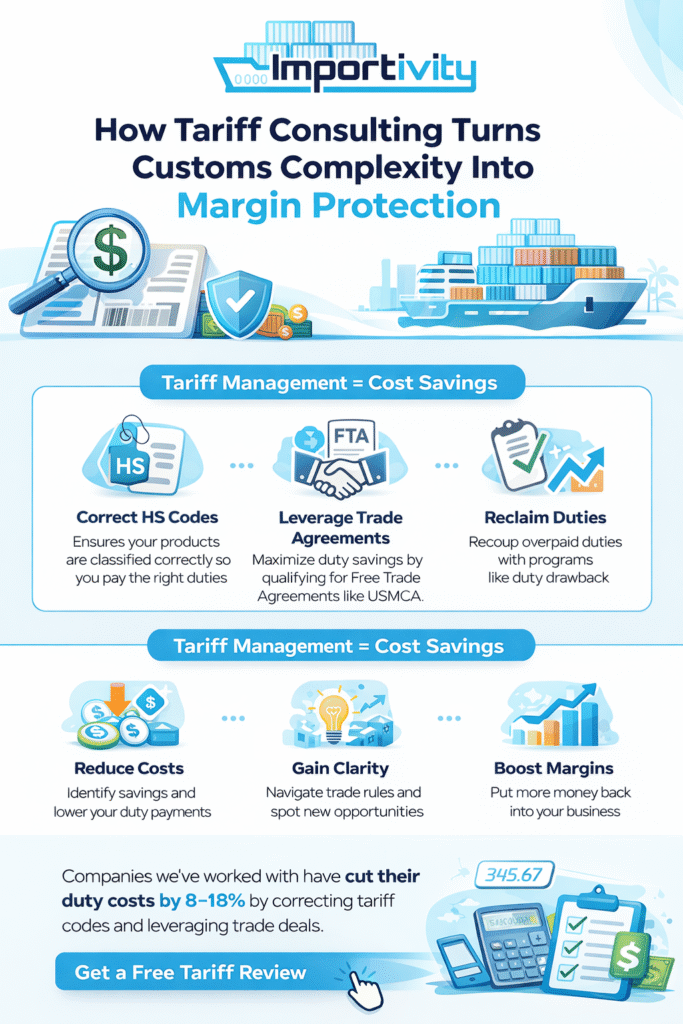

The heart of consulting lies in one goal: reducing costs with tariff strategies.

Here are the most common methods consultants use:

Strategy | How it helps | Example |

Tariff classification reviews | Identifies misclassified goods | Shifting a product to the correct HS code reduced duty by 8% for one client |

Duty drawback programs | Reclaims duties on re-exported goods | A company exporting returns claimed back thousands |

Free trade agreement planning | Ensures products qualify for reduced rates | Using USMCA rules saved a manufacturer millions |

Valuation adjustments | Ensures duties are calculated correctly | Correcting declared values avoided penalties |

What sets effective import-export tariff management apart is not only spotting savings but making those savings repeatable.

Global trade compliance solutions are a margin protection

The phrase global trade compliance solutions can sound large, but in practice, it means building confidence. Every shipment cleared without delay is a win for cash flow. Every avoided penalty is a win for your margin.

Consultants do this by:

- Reviewing product portfolios for compliance gaps

- Designing processes that scale with growth

- Training teams to catch errors early

A real-world example comes from a mid-sized retailer that moved into European markets. By applying customs duty consulting services, they avoided duplicate duties when shipping between the UK and the EU. That decision alone paid for the consulting engagement within months.

Real Stories: How Tariff Consulting Protects Margins

Numbers are important, but what convinces most companies is the experience of others. One client told us they received an answer to a tariff code question within 24 hours, and the clarity saved them from weeks of shipment delays. Another described how they had spent years assuming their margins were locked in, only to find hidden refunds waiting once consultants reviewed their past filings.

These stories highlight what data cannot. Tariff consulting works because it turns frustration into action. It makes customs a place where businesses feel in control again.

Where import export tariff management fits in business planning

The best time to look at tariffs is not when the goods are stuck at the border. It is during planning. With the right import export tariff management, companies can:

- Price products with accurate landed cost forecasting

- Decide where to source materials based on duty impact

- Create budgets with confidence instead of guesswork

In this way, tariff consulting becomes part of strategy meetings, not just back-office compliance.

Working with experts

Working with consultants is not about giving up control. It is about adding expertise to a team that already knows the product and market. The role of experts is to bring perspective. They know how other businesses in similar industries handle duties. They see trends before they become problems.

At Importivity, the consulting process often begins with a free review of tariff codes. From there, businesses can decide whether a full engagement makes sense. If you want to learn more, our tariff mitigation strategies guide covers real-world methods in detail.

Turn Complexity into Margin Protection

Margins will always face pressure from global shifts, but tariffs do not need to be the reason your profits slip away. With the right tariff consulting, compliance transforms into foresight, duties become opportunities for savings, and customs complexity turns into clarity.

Now is the time to act. Every shipment you move carries the potential for cost reduction. Every review of your tariff strategy is a chance to protect what you have worked hard to build.

Start protecting your margins today with Importivity’s expert customs duty consulting services. Request your free tariff review now and see where you can save.

frequently asked questions

What is tariff consulting?

Tariff consulting is expert guidance that helps businesses classify goods, apply duty savings strategies, and stay compliant.

How do customs duty consulting services reduce costs?

They identify misclassifications, apply duty drawbacks, and ensure trade agreements are used to lower duty payments.

Is tariff consulting only for large companies?

No, businesses of all sizes benefit. Small importers often see the biggest gains because they lack in-house expertise.

How do global trade compliance solutions protect margins?

They prevent costly errors, avoid penalties, and streamline processes for faster shipments.

How often should businesses review their tariff codes?

At least once a year, or whenever products, sourcing, or trade rules change.