If you work in international trade, you already know how one small miscalculation in duties can eat into your margins. That is where tariff consulting steps in. It is not just about avoiding penalties. It is about creating a clear strategy for tariffs, duties, and regulations so your business can keep more of its profits.

At Importivity, we have seen companies reduce import export costs almost overnight by addressing tariff classifications and compliance gaps. When businesses understand their tariff obligations, they stop losing money to errors and start planning smarter.

Why Tariff Consulting Matters

The world of duties and regulations is constantly changing. Governments update tariff schedules, trade agreements shift, and compliance requirements grow stricter each year. Without expert help, businesses often overpay or fall behind in meeting requirements.

- Tariff consulting helps by:

- Ensuring you are paying the right amount of duties

- Identifying exemptions or preferential rates you qualify for

- Reducing risks of costly audits or penalties

- Supporting long-term global trade compliance solutions

Think of it as preventive care for your business margins. Instead of fixing a costly mistake later, you protect your profits upfront.

The Role of Tariff Management Services

Tariff management services are the backbone of smart trade planning. These services focus on monitoring classification codes, updating duty rates, and handling documentation.

For example, imagine you are importing electronics from Asia. A small error in the HS code could double your duties. With professional tariff management services, that mistake never reaches your books.

What a Consultant Can Do for You

- Review your product portfolio for classification accuracy

- Maintain compliance with new global trade rules

- Build systems for consistent documentation and reporting

- Align duty planning with your business strategy

When these pieces are managed properly, your company spends less on unexpected costs and more on growth.

How Tariff Consulting Reduces Import Export Costs

Here is where businesses feel the most relief. Tariff consulting does not just ensure compliance. It actively works to lower your trade expenses.

Cost-Saving Examples

- Duty Drawback Programs: Claim refunds for duties paid on re-exported goods.

- Free Trade Agreements: Benefit from preferential rates that many businesses overlook.

- Classification Adjustments: Correct HS codes can lower duty percentages significantly.

- Customs Planning: Structure supply chains to take advantage of lower-cost routes.

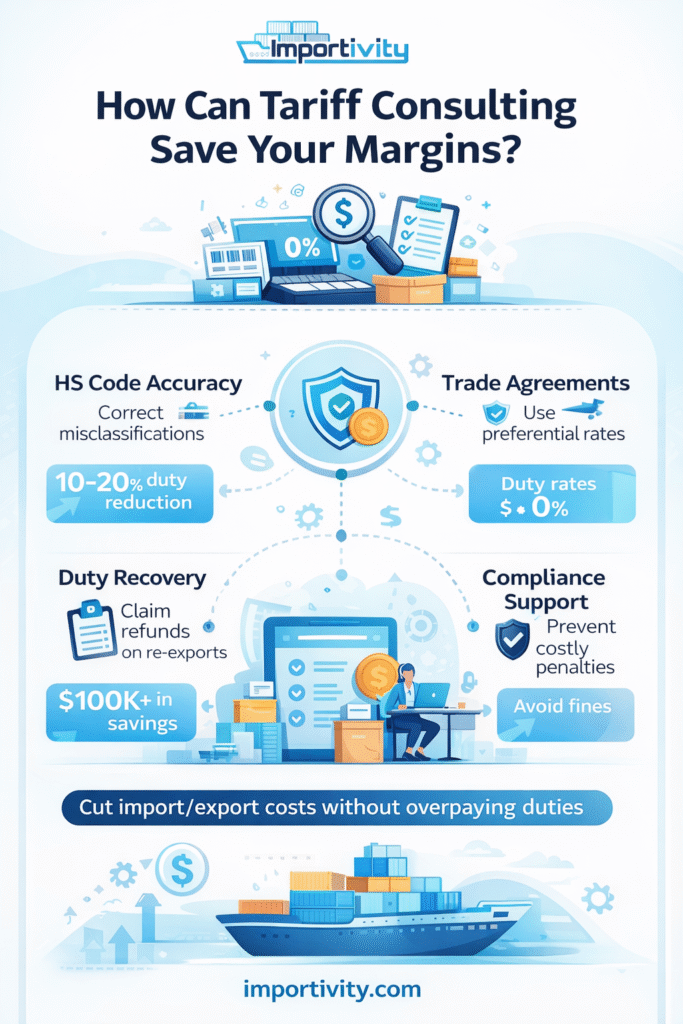

A quick look at how tariff consulting safeguards profits through smarter classification, compliance, and cost recovery.

Direct Benefits of Tariff Consulting

Area of Focus | Common Issue | How Consulting Helps | Impact on Margins |

HS Code Accuracy | Misclassification | Proper review and updates | Reduced overpayments |

Trade Agreements | Missed opportunities | Identify eligibility | Lower duties |

Compliance | Risk of penalties | Ongoing audits and training | Avoid fines |

Duty Recovery | Missed refunds | File drawback claims | Cash flow boost |

These savings add up quickly, especially for businesses that import or export at scale.

Customs Duty Consulting and Compliance Support

Customs duty consulting is often the most direct way to keep profits intact. Consultants ensure your shipments move smoothly through customs without delays or surprise charges.

Global trade compliance solutions add another layer of protection. With regulations differing in each country, it is easy to make a misstep. Consultants guide you through the process so you avoid:

- Incorrect filing of entry documents

- Penalties for late submissions

- Overlooked changes in duty rates

This mix of customs duty consulting and compliance keeps your business resilient in any market.

Keeping Track of Tariff Shifts

Even the best tariff consulting strategy needs to adapt as rules change. For example, the Trump-Era Tariff Tracker & Guide highlights several areas businesses should monitor closely:

- Shifting tariff rates for goods from certain countries that miss these changes can eat directly into margins.

- Suspension of de minimis imports, smaller parcels that used to be duty-free, may now be taxed.

- Section 301 exclusions: Knowing whether your products fall under active exclusions can reduce costs significantly.

- Expiry dates on duty reductions marking these dates ensure you do not lose benefits unexpectedly.

These are the kinds of real-time updates a consultant helps you navigate, so you are never caught off guard.

Why Businesses Delay Tariff Consulting and Pay the Price

Despite the clear benefits, many businesses wait until a problem arises. The common reasons include:

- Thinking it is too costly

- Believing their in-house team has it covered

- Not realizing how much money is being lost

In reality, the cost of tariff consulting is far lower than the losses caused by compliance mistakes or overpaid duties.

Choosing the Right Tariff Consulting Partner

When selecting a consultant, look for proven experience in global trade. Transparency and responsiveness are critical. For instance, clients at Importivity have shared how they received offers within a day and got clear answers to every question. That level of care is what builds trust.

If you are ready to explore how tariff consulting can protect your business, you can learn more about our import export agency services here.

Protect Your Margins with Importivity

Global trade is challenging, but your profits do not have to shrink because of it. With the right tariff consulting from Importivity, you can meet compliance requirements and create a reliable system that keeps costs under control while protecting your margins.

If you are ready to reduce import export costs and simplify compliance, now is the time to act. Get in touch with Importivity today and let us help you secure your business profits in global trade.

frequently asked questions

What is tariff consulting?

Tariff consulting helps businesses classify products correctly, comply with regulations, and reduce duties paid in global trade.

How can tariff management services help?

They ensure codes and documentation stay updated so businesses avoid errors and unnecessary costs.

Can tariff consulting reduce import export costs significantly?

Yes. By identifying refunds, exemptions, and correct classifications, costs can drop immediately.

What industries benefit most from customs duty consulting?

Industries with complex supply chains, such as electronics, textiles, and automotive, gain the most.

Do small businesses need global trade compliance solutions?

Absolutely. Even small businesses face penalties for non-compliance, so expert support is vital.