Nearshoring to Mexico is no longer a trend; it is a practical strategy for US brands. Companies want shorter supply chains, faster delivery, and lower costs. Manufacturing close to home provides all three. Unlike overseas production, working with Mexican partners allows businesses to reduce shipping times to US markets and stay flexible.

For many US brands, Mexico’s manufacturing advantages go beyond cost savings. The real win is combining speed, resilience, and access to skilled labor. The question is no longer “Should we move production?” but “How fast can we shift to nearshoring to Mexico?”

Why US brands are rethinking global supply chains

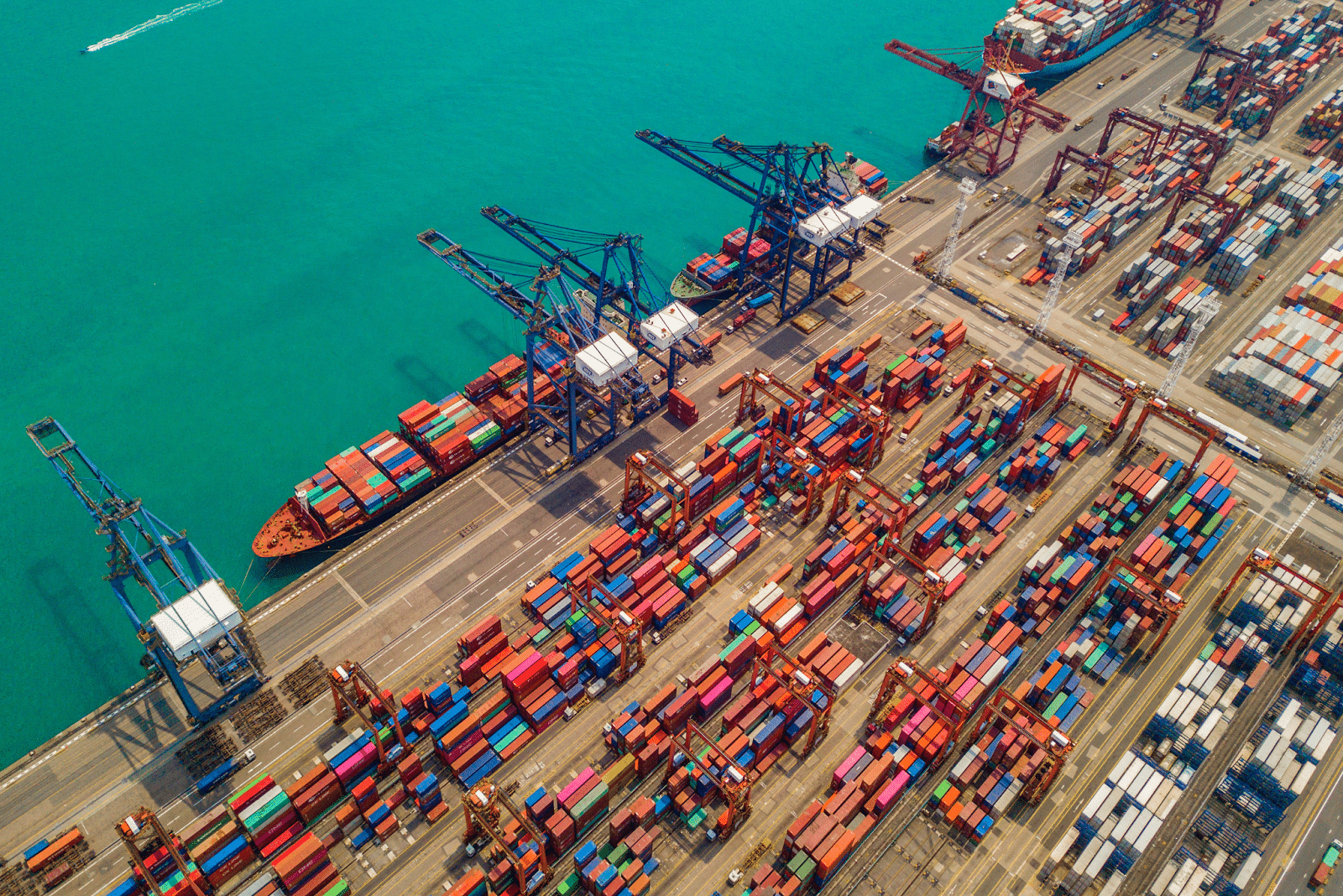

The pandemic exposed how fragile long supply chains can be. Shipping containers sat offshore for weeks. Freight prices skyrocketed. Brands lost sales because shelves stayed empty. Consumers, however, still expected speed and reliability.

Mexico offers a solution. Instead of waiting months for products shipped from Asia, companies can bring goods across the border in days. The difference between three weeks and three days is massive when competing in fast-moving markets like retail, electronics, or fashion.

Mexico's manufacturing advantages at a glance

Here are some of the key reasons US brands are moving production south:

Advantage | Benefit to US Brands |

Shorter distance | Reduce shipping times to the US by up to 80 percent |

Skilled workforce | Access experienced labor at a lower cost |

Trade agreements | Duty benefits through USMCA |

Time zone alignment | Easier communication and coordination |

Cross-border logistics Mexico-US | Streamlined trucking and customs processes |

Each factor alone would make a difference. Together, they create a supply chain that is cheaper, faster, and more resilient.

Reducing costs through nearshoring to Mexico

Cost is often the first reason companies look at nearshoring. Labor rates in Mexico remain lower than in the US. At the same time, the workforce is highly trained in areas like automotive, aerospace, and electronics.

When you add lower shipping costs, the savings multiply. A container shipped from Asia to Los Angeles can cost thousands more than trucking goods across the border. These savings allow brands to invest in product development or pass savings on to customers.

Importivity works with businesses that want lower-cost nearshoring solutions without losing quality. Many clients see quotes within days and get answers to logistics questions upfront. This level of transparency makes the shift less risky.

Faster delivery with cross-border logistics

Nearshoring to Mexico also solves one of the biggest frustrations for US brands: speed. Customers expect fast fulfillment. Retailers cannot afford to wait 45 days for shipments to arrive.

Cross-border logistics between Mexico and the US are more advanced than ever. Trucks move daily through ports of entry like Laredo and El Paso. With the right partners, shipments clear customs quickly and arrive in US warehouses in under a week.

This speed opens doors for industries with seasonal or trend-driven products. Apparel companies, for example, can react to fashion cycles much faster. Electronics brands can adjust production runs when demand shifts suddenly.

Real business impact

Consider a small electronics brand that imports from Asia. Each shipment took 40 days to arrive. By the time new products hit the shelves, consumer interest had shifted. After moving production to Mexico, the same shipments crossed the border in four days. Sales improved simply because the brand kept pace with demand.

This is the hidden advantage of nearshoring to Mexico. It is not just about saving on freight. It is about protecting sales by staying relevant and available.

Mexico's manufacturing advantages in workforce and quality

Another reason brands look to Mexico is the workforce. Engineers and technicians in Mexico are experienced in high-precision manufacturing. Many US companies are surprised by the quality levels they achieve without the learning curve of other low-cost regions.

Because production is closer, US managers can visit factories more often. This face-to-face contact strengthens relationships and keeps quality standards consistent. Time zone alignment also makes communication faster. A call at 10 AM in Dallas is also 10 AM in Monterrey.

Lower risk compared to overseas production

Faraway supply chains carry more risk. Political changes, tariffs, or disruptions at major ports can delay production. Nearshoring reduces those risks. Mexico and the US are tightly linked by the USMCA, which stabilizes trade rules and duties.

This stability matters to brands that want predictable costs. With fewer surprises, planning becomes easier.

Is nearshoring right for every brand

Not every product category is a perfect fit. Some industries still depend on raw materials or suppliers based in Asia. However, for many consumer goods, electronics, auto parts, and apparel, the shift is worth serious consideration.

Importivity helps brands evaluate whether their products are suitable for Mexico manufacturing. Sometimes, even partial production in Mexico creates major savings and faster delivery.

How nearshoring compares to reshoring

Some US brands are considering reshoring, or bringing production back to the United States. Reshoring has its benefits, like supporting domestic jobs. But costs often remain high compared to nearshoring to Mexico.

Mexico offers a balance. Production is close enough to improve delivery speed but affordable enough to compete on cost. Many companies choose Mexico as a middle ground between full reshoring and global outsourcing.

The future of nearshoring to Mexico

The trend shows no signs of slowing down. Analysts expect more US brands to diversify away from Asia. As supply chains grow more regional, Mexico stands out as the top partner for US companies.

The growth of industrial parks, logistics hubs, and cross-border trade systems will make nearshoring even more practical. Brands that act now position themselves ahead of competitors who continue to rely on slower overseas supply chains.

Conclusion

Nearshoring to Mexico gives US brands a clear path to reduce costs and improve delivery speed. The combination of skilled labor, shorter shipping routes, and strong trade agreements makes it a smart strategy.

Whether a brand wants lower-cost nearshoring solutions, better cross-border logistics, or simply the ability to reduce shipping times to US markets, Mexico offers real advantages.

For companies looking to grow without the constant risk of global delays, nearshoring is not just an option. It is becoming the default strategy.

Take the Next Step with Importivity

Why wait months for shipments when your products could be in US stores within days? At Importivity, we help brands connect with trusted Mexico manufacturers and simplify the nearshoring process.

- Lower your costs.

- Speed up your delivery.

- Build a supply chain that works for today’s demands.

frequently asked questions

What is nearshoring to Mexico?

It is the practice of moving production from distant countries to Mexico, closer to US markets.

How does nearshoring reduce shipping times to the US?

Goods move by truck across the border, cutting transit from weeks to just a few days.

Are costs really lower in Mexico?

Yes. Labor and logistics costs are typically lower than in the US and even lower when compared to Asia, plus ocean freight.

What industries benefit most from Mexico's manufacturing advantages?

Electronics, apparel, automotive, aerospace, and consumer goods benefit most from proximity and skilled labor.

How do I start working with Mexican manufacturers?

You can connect through trusted partners like Importivity, which helps brands find reliable factories and logistics support.