If you import products for your business, you already understand the excitement of seeing your shipment arrive, followed almost immediately by the sting of a tariff bill that slashes your expected profit margin. Suddenly, your product pricing feels tighter, and you start wondering how deeply tariff impact actually affects your overall product cost. The truth is, tariffs go far beyond a simple tax. They have a cascading effect on your supply chain, your pricing strategy, and even on how your customers perceive your brand’s value.

Fortunately, by adopting strategic customs duty practices and taking proactive measures, businesses can reduce costs and, in many cases, effectively beat tariff impact altogether. Let’s explore how tariffs work, how they influence your product pricing, and what practical steps you can take to manage or eliminate their burden.

What Exactly Are Tariffs and Why Do They Matter

Tariffs are essentially government-imposed taxes on imported goods. They are intended to achieve two main goals: protecting local industries by making imported goods more expensive and generating revenue for the government itself. On paper, tariffs appear straightforward; however, their real-world effects can snowball into significant cost increases across your entire business ecosystem.

For instance, if you import kitchen appliances from Asia, a 15 percent tariff might seem manageable at first. Yet, when you include customs clearance fees, handling costs, and the additional markup required to preserve your profit margins, that 15 percent tariff can easily evolve into a 25–30 percent overall price increase.

Because of this compounding effect, the tariff impact on businesses often feels far more severe than the initial tax percentage suggests.

Understanding Tariff Impact on Product Cost Beyond the Numbers

When analyzing tariff impact on product cost, it’s essential to look beyond surface-level numbers. Tariffs create both direct and indirect costs that affect nearly every part of your operations.

1. Direct Costs That Drive Up Prices

- The direct customs duty charged on your imported goods.

- Increased shipping fees due to port congestion or added inspections.

- Extra handling or storage charges for goods subject to higher-risk categories.

2. Indirect Costs That Erode Margins

- Adjusted pricing strategies to remain competitive in changing markets.

- Shifts in customer demand as prices increase.

- Strain on supplier relationships when discounts or shared costs become necessary.

Ultimately, tariffs don’t just adjust your financial spreadsheet; they reshape your supply chain and influence every downstream decision, from sourcing to retail pricing.

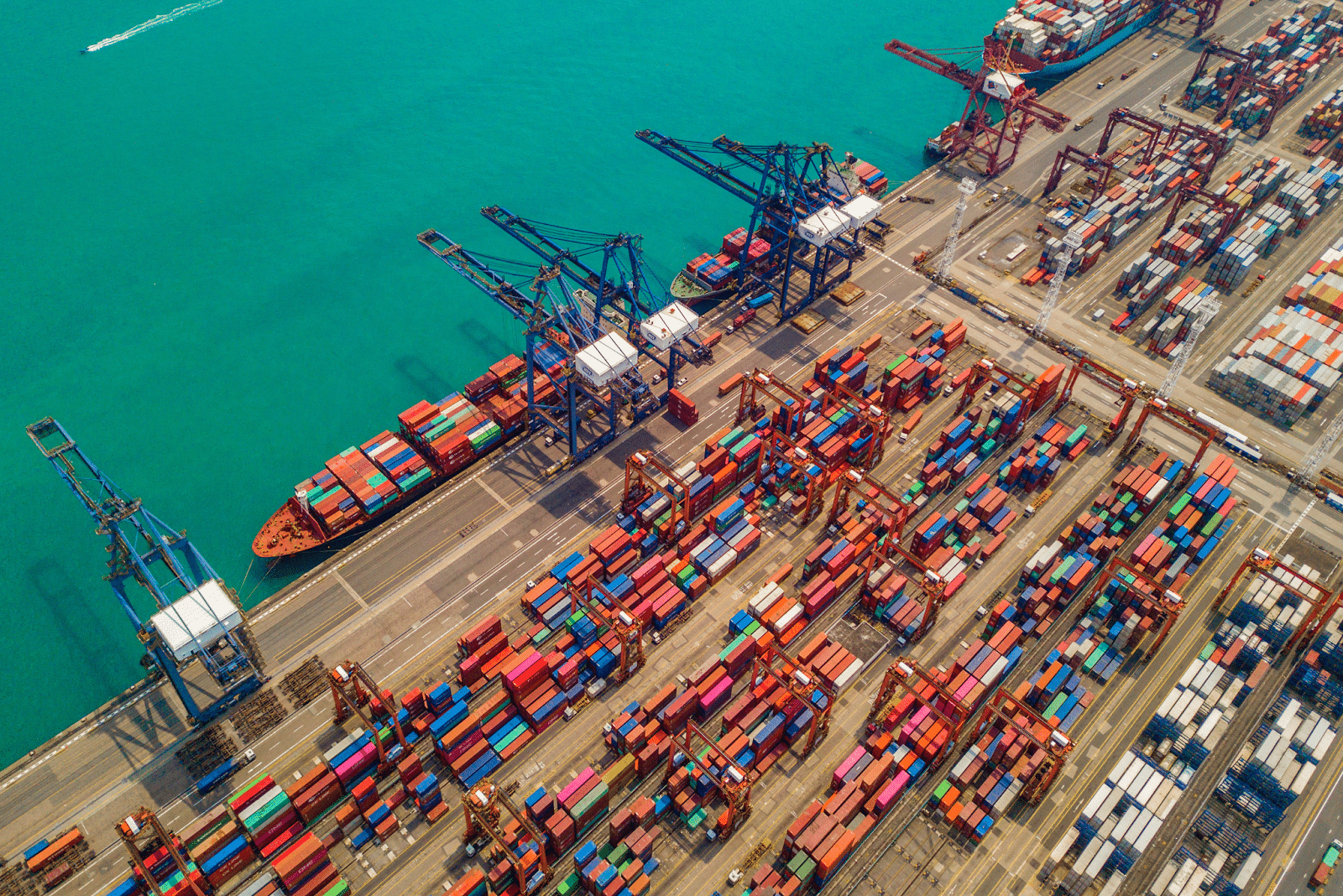

Trade Wars and Their Tariff Impact on Global Pricing

The recent trade tensions between the United States and China provided a clear example of just how disruptive tariff impact can be across multiple industries.

For instance:

- Electronic and tech products experienced price spikes ranging from 20–30 percent within weeks.

- Clothing brands had to choose between absorbing costs or passing them along to customers.

- Small importers faced the difficult decision of discontinuing unprofitable product lines altogether.

These trade war lessons taught businesses that tariffs are not simply a cost factor; they are a strategic variable that can redefine your entire business model if left unmanaged.

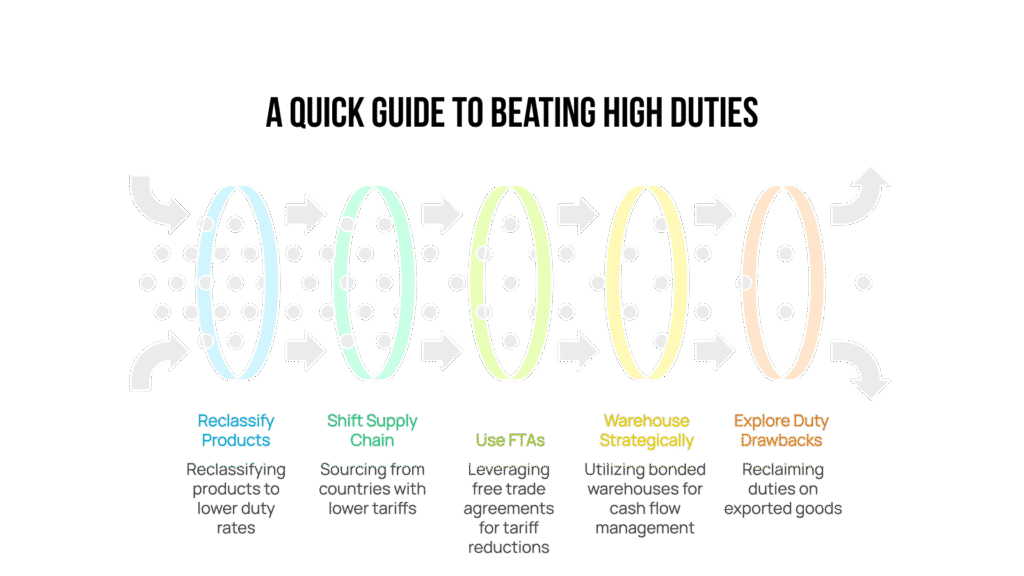

Customs Duty Strategies to Reduce Tariff Impact

Fortunately, there are multiple strategies available to minimize tariff impact and protect your profit margins. By planning smartly and understanding your import data, you can navigate tariff structures more effectively.

1. Reclassify Your Products

Each product is assigned an HS code that determines its duty rate. Even small classification differences can lead to major cost changes. For example, reclassifying a product as a “component” instead of a “finished good” can sometimes cut your tariff rate by half.

2. Shift Your Supply Chain

Sourcing from alternative countries such as Vietnam, Mexico, or India can reduce exposure to certain tariffs without compromising quality. Strategic diversification can insulate you from sudden trade policy changes.

3. Use Free Trade Agreements (FTAs)

Many countries have FTAs that eliminate or significantly lower tariffs. If your product qualifies under an FTA, you could save thousands per shipment, dramatically reducing tariff impact on your landed cost.

4. Warehouse Strategically

Bonded warehouses allow importers to delay paying tariffs until goods are sold domestically. This tactic improves cash flow and gives flexibility in managing inventory costs.

5. Explore Duty Drawback Programs

If you import goods that are later exported even in a modified form, certain regions allow you to reclaim previously paid duties. This can be an invaluable cost recovery strategy.

Simplifying Tariff Impact with Management Tools

Managing tariffs manually can be time-consuming and error-prone. Thankfully, modern tariff management tools have simplified this process significantly. These platforms can automate complex calculations, ensuring compliance and accuracy.

They can:

- Automatically classify products and calculate applicable duties.

- Monitor real-time tariff updates across different countries.

- Compare global sourcing options for optimal decision-making.

- Maintain compliance documentation for audits.

By integrating these tools into your import workflow, businesses can improve efficiency, minimize costly mistakes, and maintain a clearer understanding of total product costs.

Practical Tips to Avoid High Tariff Impact on Imports

Even if a complete supply chain overhaul isn’t feasible immediately, you can still take practical steps to minimize tariff impact right away.

Quick Actions You Can Take

- Reevaluate current HS codes for more accurate classification.

- Ask suppliers about alternative production or shipping origins.

- Negotiate tariff cost-sharing agreements with partners.

- Investigate deferred payment or reduction programs available in your region.

Incremental improvements like these can add up, helping you regain control over your profit margins.

Why Partnering with Experts Can Reduce Tariff Impact

Navigating tariff structures requires more than administrative knowledge; it demands strategic foresight. Partnering with professional import-export consultants can drastically reduce tariff impact by identifying overlooked opportunities.

For instance, one Importivity client facing a 20 percent duty increase collaborated with a consultant who discovered a more favorable HS code and qualified their product for a free trade agreement. As a result, they reduced their tariff costs significantly and maintained profitability.

This example demonstrates how expert guidance transforms tariff management from reactive cost control to proactive business optimization.

Staying Ahead of Tariff Impact Through Strategic Planning

Global trade regulations are constantly evolving. Tariff rates can decrease one quarter and skyrocket the next, creating an unpredictable environment. However, businesses that adopt a proactive approach using technology, strategic sourcing, and expert insights are better equipped to thrive despite volatility.

By regularly reviewing classification codes, engaging with trade professionals, and leveraging management software, you can reduce uncertainty and maintain a competitive edge in your market.

For instance, one Importivity client facing a 20 percent duty increase collaborated with a consultant who discovered a more favorable HS code and qualified their product for a free trade agreement. As a result, they reduced their tariff costs significantly and maintained profitability.

This example demonstrates how expert guidance transforms tariff management from reactive cost control to proactive business optimization.

Take Control of Tariff Impact with Importivity

Tariffs will always be a part of global trade, but they don’t have to define your profitability. With intelligent customs duty strategies, careful supply chain management, and expert consultancy, you can not only reduce tariff impact but also turn it into an advantage.

At Importivity, we specialize in helping importers streamline processes, optimize classifications, and uncover cost-saving opportunities hidden in complex trade policies. Whether you’re facing sudden tariff increases or planning for future resilience, our experts are ready to guide you every step of the way.

frequently asked questions

How do tariffs impact product cost most directly?

Tariffs raise the landed cost of goods by adding a tax at import. This affects both wholesale and retail pricing.

What are the common trade war effects on pricing?

Prices often rise across entire industries, profit margins shrink, and businesses are forced to either shift supply chains or pass costs onto consumers.

How can businesses avoid high tariffs on imports?

Strategies include product reclassification, sourcing from countries with lower tariffs, using FTAs, and applying for duty drawback programs

Are tariff management tools worth it for small businesses?

Yes, they simplify compliance, reduce errors, and provide clear cost forecasting, which is critical for smaller importers with tighter margins.

Should I handle customs duty strategies on my own?

You can, but working with professionals often saves time and money by identifying savings you might miss on your own.