Sourcing Agent Vietnam

Your Trusted Partner for Vietnam Manufacturing Sourcing

Sourcing Agent Vietnam

Your Trusted Partner for Vietnam Manufacturing Sourcing

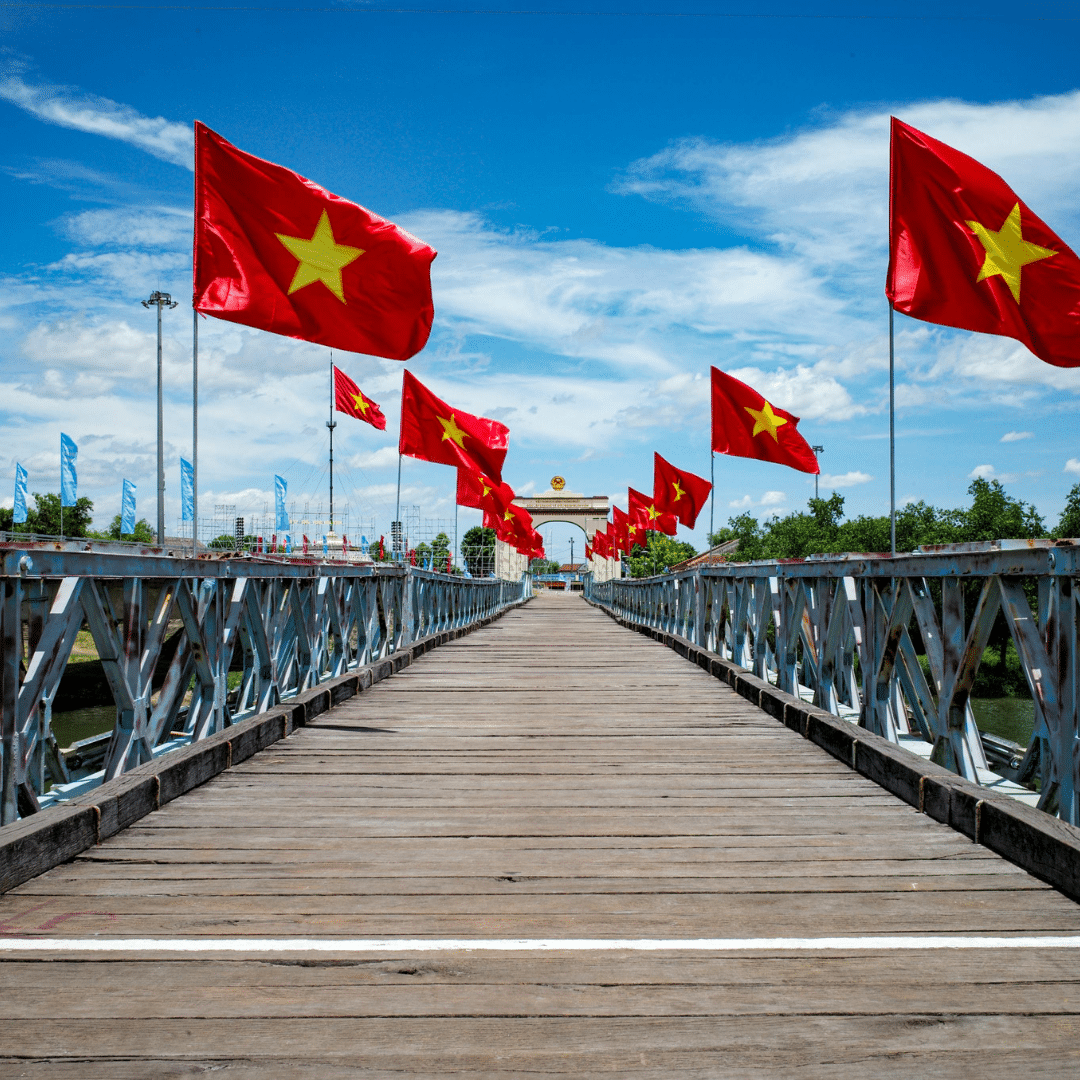

Why U.S. Companies Choose Vietnam for Manufacturing

Vietnam has emerged as one of the most important destinations for U.S. companies diversifying their supply chains. With competitive labor costs, favorable trade agreements, and growing expertise in industries like textiles, plastics, metals, and electronics, Vietnam offers real advantages over China. Importivity is your end-to-end sourcing agent in Vietnam, with a full-time team on the ground in Ho Chi Minh City handling factory sourcing, quality control, logistics, and compliance every step of the way.

Importivity is your end-to-end sourcing agent in Vietnam, with a full-time team on the ground in Ho Chi Minh City handling factory sourcing, quality control, logistics, and compliance every step of the way.

Why Work With a Sourcing Agent in Vietnam?

Unlike traders or brokers, a true sourcing agency in Vietnam gives you transparency, leverage, and risk reduction. Importivity connects you directly to vetted factories, negotiates favorable terms, and ensures compliance with U.S. import laws. Our presence in Vietnam means your production runs are monitored in real time — no costly surprises or quality issues.

Case Studies from Vietnam

Explore some of our recent case studies where we helped clients source products and reverse source products from Vietnam.

$100,000+ Containers of Durian Exported to China

How Importivity secured high-value, cold-chain exports from Vietnam to Guangzhou by pairing trusted buyers with tight payment terms and transparent delivery schedules.

The Challenge

Buyer Risk · Compliance · Temperature Control

Our Approach

Trusted Network · Structured Terms

Farm Pack & Pre-Cool

Grading, packing, pre-cooling; temp & pulp checks logged.

Stuffing & Seal

Reefer set-point validated; container sealed; photos + seal no. recorded.

Export Clearance

Commercial docs + phytosanitary certification; origin & HS reviewed.

Arrival & Market Transfer

Customs inspection as required; temperature strip verified; handover at Guangzhou Import Market.

Results

Market Entry · Repeatability

Reverse Sourcing a National Beverage Launch

How Importivity traced a proven product’s supply chain, negotiated direct factory access, and helped a client launch fast—without costly R&D.

The Challenge

Speed to Market · Avoid R&D

Our Approach

Supply-Chain Intel · Direct Access

Results

Scale · Savings · Speed

Vietnam Manufacturing Sourcing: Key Industries

We act as your local sourcing agent / agency, bridging your business with Vietnamese manufacturers.

Plastics Injection Molding

Vietnam’s plastics sector is growing rapidly, particularly in consumer goods packaging and household items. While not yet as advanced as China, Vietnam offers tariff-free advantages and reliable mid-scale production for brands looking to reduce landed costs.

Metals & CNC Machining

From furniture hardware to automotive components, Vietnam’s metalworking sector is expanding with modernized factories and foreign investment. Importivity ensures you connect with CNC and fabrication partners that can deliver quality without the overhead of Chinese tariffs.

Electronics Assembly

Vietnam is becoming a serious player in electronics assembly, with major brands already shifting production from China. While complex, high-precision devices still favor Shenzhen, Vietnam is an excellent choice for consumer electronics and mid-tier assembly.

Textile Manufacturing Sourcing

Vietnam is globally recognized for its textiles and apparel industry. From athletic wear to private-label clothing, Vietnam offers low-cost, scalable production with strong compliance standards. This makes it ideal for U.S. brands seeking both affordability and reliability.

Why U.S. Companies Choose Vietnam with Importivity

- Lower labor costs and tariff avoidance compared to China.

- Direct flights and strong trade relations with the U.S. and EU.

- On-the-ground team in Vietnam managing sourcing, QA, compliance, and logistics.

- Access to textiles, plastics, metals, and electronics factories without unnecessary middlemen.

- A partner that speaks the language, understands the culture, and negotiates on your behalf.

sUBMIT A SOURCING REQUEST UNDER 2 MINUTES

Verify your email and submit a sourcing request so we can quickly review your needs and start helping you find the right products or manufacturers.

Book now by picking any open slot below.

Latest Tariff Updates Between the USA & Vietnam

Most Recent Update: 10:27 PM CST September 24th, 2025

Reciprocal Tariff: 20% on Vietnamese Goods

Effective: Aug 7, 2025

U.S. baseline raised from 10% → 20%

40% Tariff on Suspected Transshipment via Vietnam

Substantial Transformation

Enforcement Focus

Mid-2025 Deal: VN Exports at 20%; U.S. Goods Duty-Free into Vietnam

Bilateral Context

Transshipment rule still 40%

How These Resources Fit Into Your Strategy

Importivity gives away what others charge for. From RFQ templates to BOM checklists, tariff trackers, and a landed cost calculator, our Resources Hub is built to save you time and money. These tools don’t just educate — they generate real ROI before you even sign a contract.

BOM Template

Use the BOM Template to organize your product specs.

RFQ Template

Follow with the RFQ Template to collect accurate supplier quotes.

Factory Visit Checklist

Visit suppliers using the Factory Visit Checklist.

Supplier Onboarding Checklist

Once you select a partner, implement the Supplier Onboarding Checklist.

Landed Cost Calculator

Use the Landed Cost Calculator to forecast true costs and finalize pricing.

Product Sourcing Guide

Importivity Product Sourcing Experts

Trusted partners in finding, vetting, and managing global manufacturers with full cost transparency.

The Team Behind Transparent Global Trade

Tanner Plante

Jordan Lewis

Courtney King

Lila Manroe

Sourcing Company Case Studies

Real examples of how our sourcing company delivers results across industries and markets.

Frequently Asked Questions

If you need further assistance, feel free to reach out to our team!

Why should I work with a sourcing agent in Vietnam?

A sourcing agent in Vietnam connects U.S. companies directly to vetted factories, helping you cut costs, avoid tariffs, and reduce risk. With Importivity’s full-time team based in Ho Chi Minh City, we manage factory sourcing, negotiations, inspections, compliance, logistics, and customs—so your supply chain is seamless from start to finish.

What industries is Vietnam best known for?

Vietnam excels in textiles and apparel, plastics manufacturing, metal fabrication, and electronics assembly. It’s also a rising hub for consumer goods and packaged foods. For U.S. companies, Vietnam offers lower labor costs and tariff advantages compared to China, making it a powerful choice for industries where margins are tight.

How do U.S. tariffs impact sourcing from Vietnam?

As of September 2025, Vietnamese exports to the U.S. face a 20% reciprocal tariff, with a 40% tariff applied to goods suspected of Chinese transshipment. However, Vietnam remains attractive because its costs are still significantly lower than China’s, and many U.S. companies use Importivity to structure deals that stay tariff-compliant.

Is Vietnam manufacturing sourcing reliable for long-term partnerships?

Yes. Over the past decade, Vietnam has become one of the most reliable factory sourcing agency hubs in Asia. With strong foreign investment, industrial park development, and compliance improvements, Vietnam offers stability and scalability. Importivity strengthens this reliability by conducting multi-stage QA inspections and supplier vetting before you commit.

What are the challenges of sourcing from Vietnam?

While Vietnam is strong in labor-intensive and mid-tech industries, challenges include longer lead times compared to Mexico, and imported raw materials that can raise costs. Language barriers and fragmented supply chains also exist. With Importivity as your sourcing partner, you avoid these pitfalls and gain access to trusted, pre-qualified suppliers.

Can Importivity help with textile manufacturing sourcing in Vietnam?

Absolutely. Vietnam is one of the world’s leading exporters of apparel and textiles. Importivity has direct connections with factories specializing in clothing, footwear, and technical fabrics. We help U.S. brands balance cost, compliance, and speed-to-market while navigating Vietnam’s strengths in labor cost savings and large production capacity.

How does Vietnam compare to China or Mexico for sourcing?

Vietnam vs. China: Vietnam offers lower labor costs and tariff advantages, while China still dominates in scale and advanced electronics.

Vietnam vs. Mexico: Vietnam provides larger labor pools and lower wages, but Mexico wins in shipping speed and nearshoring convenience.

Importivity helps clients evaluate these trade-offs so you can choose the best sourcing destination for your business.

Still have questions?

Our team is happy to help! Visit our Help Center or contact us directly.