Vietnam vs Mexico Manufacturing

Compare labor costs, tariffs, logistics, and industry strengths between two of the fastest-growing sourcing destinations. Discover which country offers the best fit for your supply chain.

Which country is the smarter choice for your supply chain?

Mexico and Vietnam are two of the fastest-growing alternatives to China for global manufacturing. Each offers compelling advantages, from Mexico’s nearshore convenience and USMCA benefits to Vietnam’s cost-effective workforce and growing role in textiles and electronics. This guide compares Mexico vs Vietnam manufacturing across costs, logistics, industries, and more so you can make the best decision for your business.

Labor Costs & Workforce

Labor costs remain one of the biggest differentiators in Mexico vs Vietnam manufacturing. Vietnam continues to attract global brands with some of the lowest wages in Asia, while Mexico balances higher wages with stronger technical training and closer alignment with U.S. industries. The right choice depends on whether your priority is affordability or specialized expertise.

Winner: Vietnam

Vietnam’s labor costs remain among the lowest in Asia, making it highly attractive for labor-intensive industries like apparel, footwear, and simple assembly work. For startups and consumer brands, the ability to cut labor costs by 30–50% compared to Mexico can be a game changer.

Why choose Mexico anyway?

Mexico’s wages are higher, but its workforce is closer to the U.S. market and trained in more specialized industries like automotive, aerospace, and heavy equipment. If your business needs skilled labor with technical expertise rather than high-volume, low-cost production, Mexico is a better fit.

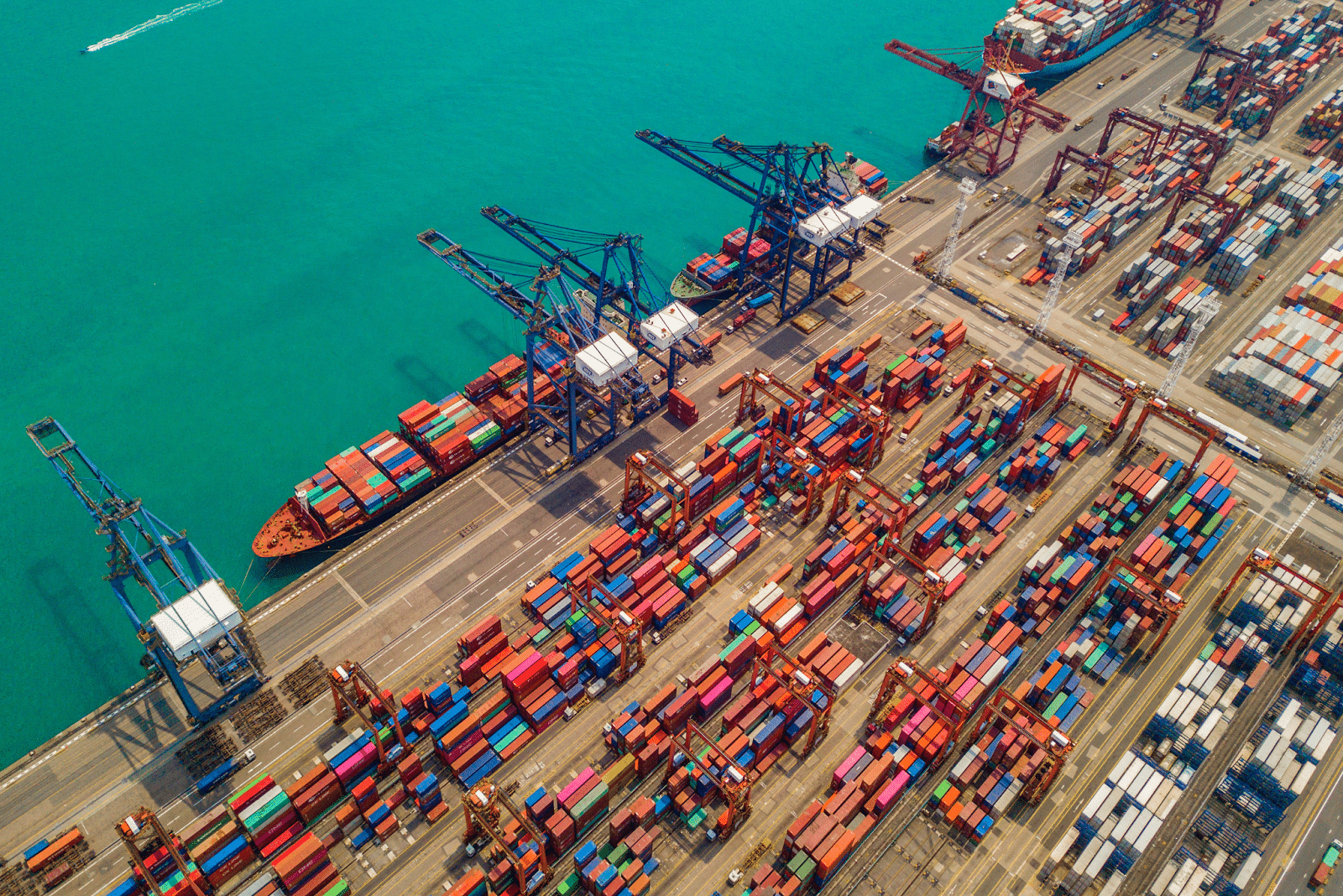

Supply Chain & Infrastructure

Infrastructure plays a critical role in consistent production and reliable delivery. Mexico has long-established industrial hubs connected by efficient highways and border crossings, while Vietnam has rapidly expanded with modern industrial parks and upgraded ports. Both countries offer competitive supply chain ecosystems, but their strengths cater to different markets.

Winner: Mexico

Mexico’s infrastructure is already tightly integrated with U.S. supply chains. Highways, cross-border trucking, and well-developed industrial parks support just-in-time delivery. Manufacturers can benefit from faster delivery cycles and reduced logistics costs.

Why consider Vietnam anyway?

Vietnam’s infrastructure continues to improve rapidly. The government has invested heavily in ports, industrial zones, and utilities to support global brands shifting production away from China. For companies aiming at Asian and European markets, Vietnam’s supply chain is increasingly competitive.

Tariffs & Trade Policy

Trade agreements often determine the total landed cost. Mexico benefits from the USMCA, which allows many goods to enter the U.S. tariff-free, while Vietnam leverages CPTPP and EVFTA to strengthen ties with Asian and European markets. Understanding which trade bloc your business serves most can swing the decision in favor of one country.

Winner: Mexico

The USMCA (United States–Mexico–Canada Agreement) gives Mexico a major edge for U.S. importers. Many products qualify for duty-free treatment, significantly reducing landed costs. Proximity also minimizes exposure to geopolitical tariff risks.

Why consider Vietnam anyway?

Vietnam is part of multiple trade agreements like CPTPP and EVFTA, which benefit European and Asian importers. For companies selling globally (not just in North America), Vietnam’s trade policy can provide wider access to international markets.

Vietnam vs Mexico Industry Comparisons

Compare how Vietnams scale and infrastructure measure up against Vietnam’s cost savings and trade advantages in plastics, metals, electronics, and textiles.

Plastics Manufacturing

Winner: Mexico

Mexico is better positioned for plastics tied to the automotive and consumer goods industries, with robust injection molding and die casting capacity already serving U.S. OEMs. Faster delivery and easier compliance with U.S. standards make Mexico the stronger choice for high-volume plastics.

Vietnam’s Edge

Better suited for smaller runs or cost-sensitive consumer products. For brands prioritizing lower labor costs or seeking tariff diversification, Vietnam’s plastics sector is developing quickly.

Metals & CNC Manufacturing

Winner: Mexico

Mexico’s metals sector is mature, supporting industries like automotive, aerospace, and construction. Its CNC machining and fabrication capabilities are tightly integrated with U.S. supply chains, ensuring high quality and just-in-time delivery.

Vietnam’s Edge

Growing capacity for basic metal fabrication and CNC work at lower labor rates. If cost is the biggest driver and the product isn’t aerospace/automotive grade, Vietnam can be a viable alternative.

Electronics Assembly

Winner: Vietnam

Vietnam has become one of Asia’s electronics hubs, attracting investments from Samsung, Apple suppliers, and global OEMs. Its workforce is skilled in assembly, testing, and packaging, making it the best choice for electronics at scale.

Mexico’s Edge

Strong for consumer electronics destined for North America, where shorter lead times and tariff-free USMCA benefits outweigh slightly higher labor costs.

Textiles & Apparel

Winner: Vietnam

Vietnam is one of the world’s top textile exporters, specializing in apparel, footwear, and labor-intensive goods. Low costs, strong supplier networks, and favorable trade agreements make it the clear leader.

Mexico’s Edge

Useful for niche, nearshore apparel production with faster delivery cycles to the U.S. While costs are higher, brands that need rapid turnaround or smaller batch runs may prefer Mexico.

Lead Times & Scalability

Scalability defines how quickly your business can grow production. Mexico is unbeatable in fast delivery cycles for U.S.-bound goods, supporting just-in-time manufacturing. Vietnam offers lower costs at scale, making it ideal for long production runs and large export volumes. Both deliver scalability, but in different ways.

Winner: Mexico

Mexico’s ability to deliver within days to the U.S. is unbeatable, making it the best choice for businesses needing flexibility, just-in-time delivery, or frequent restocking.

Why consider Vietnam anyway?

Vietnam is highly scalable for long production runs at low cost. For brands prioritizing margin over speed, Vietnam’s supplier base can deliver massive volumes at globally competitive prices.

sUBMIT A SOURCING REQUEST UNDER 2 MINUTES

Verify your email and submit a sourcing request so we can quickly review your needs and start helping you find the right products or manufacturers.

Book A Call in less than 60 seconds

The Importivity Process

Importivity is not just another product sourcing company. Our process is built to remove uncertainty and protect margins at every stage. Here is how we make global sourcing predictable, transparent, and profitable:

Discovery

We start by defining product specifications, compliance requirements, target costs, and timelines. This step ensures we source the right factory from the start and align with your business goals.

1

Factory Vetting

Our team identifies, audits, and validates manufacturers from our global network. Unlike many sourcing companies that hand over a list of names, we confirm certifications, capacity, and reliability before you commit.

2

Sampling & Tooling

We oversee prototype development, mold and tooling creation, and pre-production validation. This stage is critical in plastics manufacturing, metal fabrication, and electronics assembly, where tooling costs and tolerances can make or break profitability.

3

Quality Assurance and Quality Control (QA/QC)

Importivity conducts inspections at every stage: pre-production, in-line, and final. This prevents quality drift, reduces rework, and ensures your products meet the standards of both your customers and regulators.

4

Compliance & Packaging

We manage testing, labeling, and certification for markets like the U.S. and EU. Whether it is RoHS for electronics, FDA for plastics, or labor compliance for textiles, our product sourcing services protect you from hidden liabilities.

5

Logistics

Our logistics team coordinates everything from factory floor to final delivery. We work with vetted freight forwarders and manage customs documentation so you avoid delays and hidden costs.

Logistics & Shipping

Speed and cost of logistics are crucial for brands competing in fast-moving markets. Mexico’s geographic advantage allows trucking into the U.S. within days, while Vietnam depends on ocean freight that takes weeks. However, Vietnam’s position in Asia gives it shorter routes to European and regional markets, making it a strong export base for global brands.

Winner: Mexico

Mexico’s geographic advantage is unmatched. Goods can be trucked directly into the U.S. in days rather than weeks. Air freight is cheaper and faster due to shorter distances, and supply chains are less exposed to maritime disruptions.

Why consider Vietnam anyway?

Vietnam still makes sense if your products are primarily targeting Asian or European markets. While ocean freight to the U.S. takes longer, the labor savings often offset additional shipping costs, especially for lightweight goods.

Sourcing Company Case Studies

Real examples of how our sourcing company delivers results across industries and markets.

Frequently Asked Questions

If you need further assistance, feel free to reach out to our team!

What are the key differences between Vietnam vs Mexico manufacturing?

The main differences between Vietnam vs Mexico manufacturing come down to cost, proximity, and industry strengths. Vietnam offers lower labor costs and is a global leader in textiles and electronics assembly, while Mexico provides faster shipping, tariff-free access under USMCA, and strong capabilities in automotive and heavy manufacturing.

Is Vietnam or Mexico better for apparel manufacturing?

Vietnam is the clear leader in textiles and apparel, thanks to its large labor force, low wages, and favorable trade agreements. Mexico, however, can be better for niche or nearshore apparel production where brands need rapid turnaround times and closer proximity to U.S. markets.

Which is more cost-effective, Vietnam or Mexico?

For labor-intensive industries like apparel or footwear, Vietnam usually offers the lowest total cost of production. Mexico, while slightly more expensive on wages, reduces overall landed cost for North American companies due to shorter shipping routes and tariff-free trade under USMCA.

How do logistics compare between Vietnam and Mexico manufacturing?

Vietnam relies heavily on ocean freight, which can add weeks to delivery times to the U.S. In contrast, Mexico offers same-week delivery by truck or rail into the U.S. This makes Mexico ideal for businesses that prioritize speed to market and shorter supply chains.

Which industries benefit most from Vietnam vs Mexico manufacturing?

Vietnam is strongest in textiles, electronics assembly, and consumer goods, while Mexico excels in metals, plastics for automotive, and industrial manufacturing. Many companies use a dual-sourcing approach, relying on Vietnam for labor-intensive goods and Mexico for nearshore, high-compliance products.

Is Vietnam or Mexico more reliable for long-term manufacturing partnerships?

Mexico often wins on reliability for U.S. companies due to cultural alignment, shared time zones, and legal protections under USMCA. Vietnam, while geographically farther, is building strong long-term capacity with major global investments in electronics and textiles, making it a trusted option for scaling production in Asia.

How do trade agreements impact Vietnam vs Mexico manufacturing costs?

Mexico benefits from USMCA, which provides tariff-free trade with the U.S. and Canada, significantly reducing landed costs. Vietnam doesn’t have the same proximity advantage, but agreements like CPTPP and EVFTA give it preferential access to Europe and parts of Asia, making it competitive for brands targeting multiple regions.

Still have questions?

Our team is happy to help! Visit our Help Center or contact us directly.