Imagine this: you’re a business owner sourcing materials or products internationally, keeping costs manageable and your customers happy. Then suddenly, new tariffs hit, and your expenses shoot up overnight. Sounds stressful, right? Well, the truth is, you’re not alone. In fact, many businesses are navigating this challenging landscape, especially now with the reintroduction of tariffs under President Trump’s administration.

These tariffs while aimed at boosting domestic production and addressing trade imbalances. Additionally, comes with a cost, one that businesses like yours might end up shouldering. However, the good news is that you don’t have to let these challenges derail your operations or profits. With the right strategies in place, you can adapt, protect your bottom line, and even uncover new opportunities amidst the changes.

In this blog, we’ll first break down Trump’s tariffs in simple terms. Furthermore, we will explore their implications for businesses like yours, and finally share actionable steps to safeguard your operations. So, without further ado, let’s dive in!

Implications for Businesses

The implementation of these tariffs can lead to several challenges:

- Increased Costs: Tariffs function as taxes on imported goods, leading to higher costs for businesses that rely on these imports. This increase can erode profit margins and necessitate price adjustments.

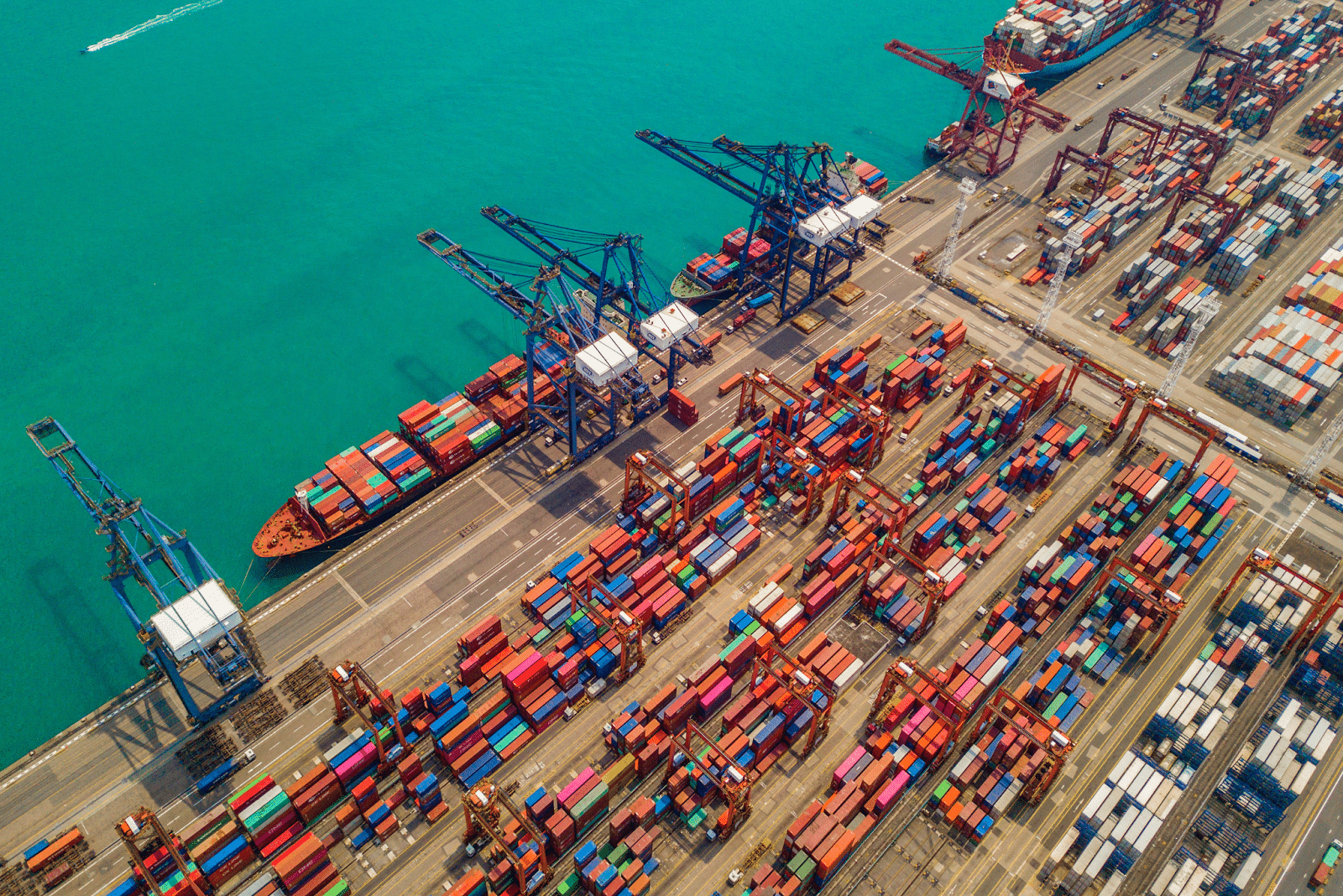

- Supply Chain Disruptions: Companies may need to reassess and modify their supply chains, seeking alternative suppliers or materials to mitigate tariff impacts.

- Market Uncertainty: The dynamic nature of trade policies can create an unpredictable business environment, complicating long-term planning and investment decisions.

Strategies to Mitigate Tariff Impacts

To navigate the challenges posed by the Trump tariffs, businesses can adopt the following strategies:

1. Diversify Supply Chains

Reducing dependence on a single country or supplier can mitigate risks associated with tariffs. Exploring alternative sourcing options in countries not subject to tariffs can help maintain cost stability and supply chain resilience.

2. Utilize Free Trade Agreements (FTAs)

Leveraging existing FTAs can provide tariff exemptions or reductions. Identifying suppliers in countries with favorable trade agreements can be a strategic move to minimize tariff liabilities.

3. Implement Tariff Engineering

Modifying products or altering the classification of goods can result in lower tariff rates. This requires a thorough understanding of tariff codes and regulations to ensure compliance while optimizing costs.

4. Explore Duty Drawback Programs

Businesses can reclaim a portion of paid tariffs on imported goods that are subsequently exported. Participating in duty drawback programs can improve cash flow and reduce overall tariff expenses.

5. Invest in Domestic Production

Shifting production to domestic facilities can eliminate exposure to tariffs. While this may involve significant upfront investment, it can offer long-term benefits, including reduced supply chain risks and potential tax incentives.

How Importivity Can Assist

At Importivity, we specialize in streamlining production while also expanding capabilities for businesses facing manufacturing overload or resource shortages. To support this, our services include:

- Product Sourcing: We help source products directly from factories, ensuring competitive pricing and quality.

- Dropshipping Services: Our full-service dropshipping solutions manage supply chain processes from product sourcing to order fulfillment.

- Private and White Label Services: We assist in finding manufacturers, designing products, and overseeing logistics under your brand identity.

- Custom Packaging: Our team provides tailored packaging solutions that align with your branding strategy.

By partnering with Importivity, businesses can navigate the complexities of tariffs and supply chain management more effectively.

Takeaways

Undoubtedly, the reintroduction of tariffs under President Trump’s administration presents significant challenges for businesses engaged in international trade. However, by thoroughly understanding the implications and proactively implementing strategic measures, companies can effectively mitigate adverse effects and continue to thrive in a changing market. Moreover, leveraging services like those offered by Importivity can provide the essential support needed to adapt to and succeed within this evolving trade landscape.

frequently asked questions

What are the new tariffs imposed by President Trump?

President Trump has announced plans to impose a 10% tariff on all U.S. imports. And with a 60% tariff specifically on Chinese goods, aiming to reshape trade relations and reduce deficits.

How can businesses reduce the impact of these tariffs?

Businesses can adopt strategies such as diversifying supply chains, utilizing free trade agreements, implementing tariff engineering, and exploring duty drawback programs. Additionally, investing in domestic production to mitigate tariff impacts.

What is tariff engineering?

Tariff engineering involves modifying products or altering their classification to qualify for lower tariff rates. Furthermore, it requires a thorough understanding of tariff codes and regulations.

How can Importivity assist businesses in managing tariffs?

Importivity offers services like product sourcing, dropshipping, private and white label services, and custom packaging. In order to help businesses streamline production and expand capabilities, effectively manage challenges posed by tariffs.

What are duty drawback programs?

Duty drawback programs allow businesses to reclaim a portion of paid tariffs on imported goods that are subsequently exported. It is improving cash flow and reducing overall tariff expenses.