Mexico Manufacturer Connections

Discover why Mexico is quickly becoming the top choice for U.S. companies seeking nearshore manufacturing, tariff protection, and faster lead times. Importivity helps you tap into Mexico’s strengths while avoiding common pitfalls.

Importivity helps you tap into Mexico’s strengths while avoiding common pitfalls.

Mexico Manufacturer Connections

Discover why Mexico is quickly becoming the top choice for U.S. companies seeking nearshore manufacturing, tariff protection, and faster lead times. Importivity helps you tap into Mexico’s strengths while avoiding common pitfalls.

Importivity helps you tap into Mexico’s strengths while avoiding common pitfalls.

Why Mexico? The Nearshore Advantage

For U.S. companies looking to reshore or launch new projects, Mexico offers an ideal mix of cost savings, convenience, and trade advantages. Under USMCA, many goods can be produced and imported tariff-free, reducing landed costs significantly compared to Asia.

No Visa Required for U.S. Business Travel

Travel Ease

Fast Site Visits

Flights from $100 · Only 2–3 Hours from Major Hubs

Proximity

Low Travel Cost

Growing Workforce with English Common in Manufacturing

Workforce

Communication

China “Sister Facilities” in Mexico Hedge Section 301

Tariff Strategy

China → Mexico

Nearshore Manufacturing in Mexico

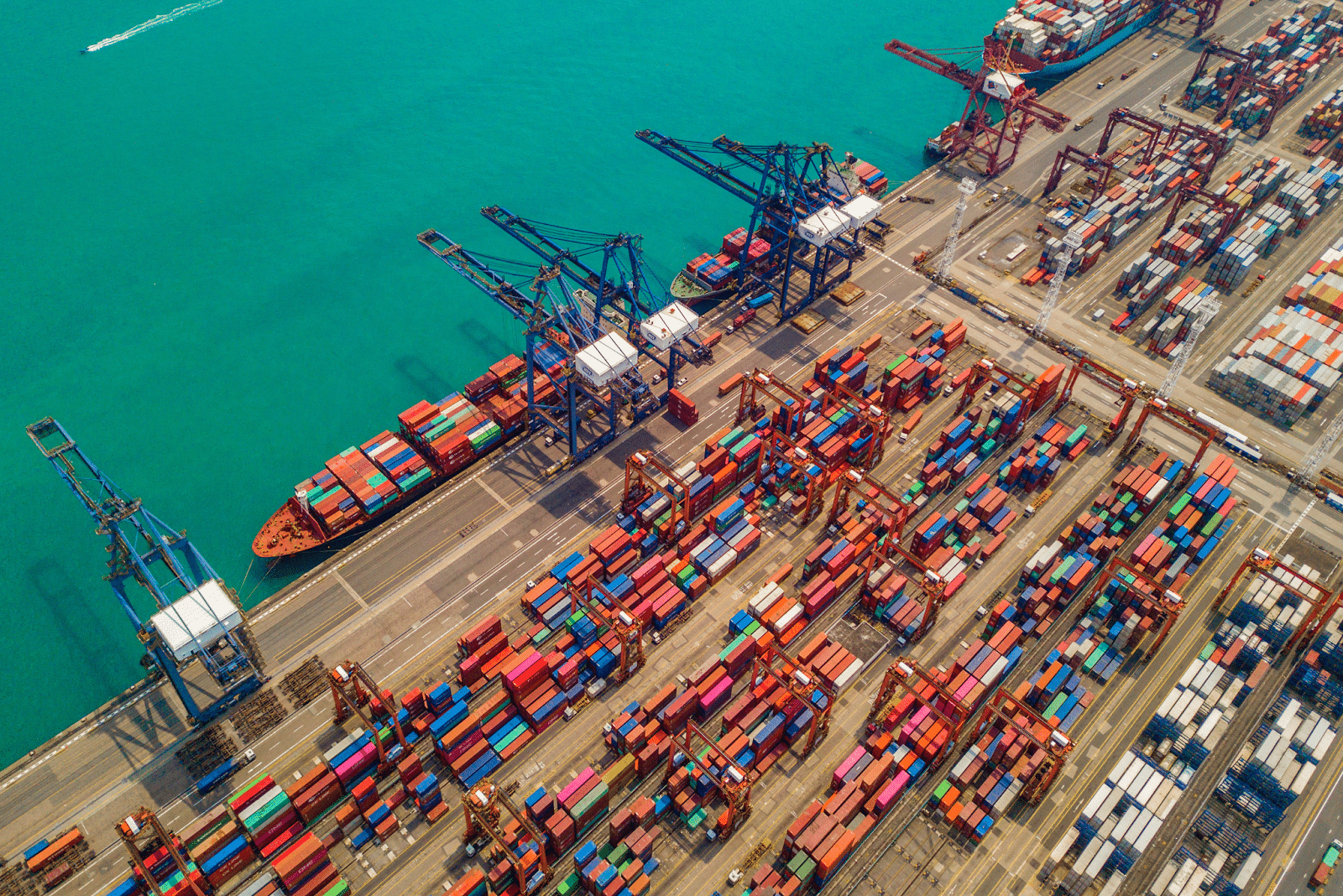

Because of geographical proximity to the U.S., Mexico offers one of the strongest nearshore manufacturing options.

- Lead times: cross-border trucking in 1–7 days (vs weeks for transpacific shipping)

- Lower freight cost: less risk of supply chain delay

- Easier logistics: fewer customs steps, reduced transit distance

- Examples: factories in northern Mexico shipping directly to U.S. states, border crossing efficiency

Doing Business in Mexico is Easier Than You Think

Mexico is one of the most accessible sourcing destinations for U.S. companies.

No Visa Required for U.S. Citizens

Traveling to Mexico for business is hassle-free. U.S. citizens can enter without a visa, making factory visits and supplier meetings far easier than in Asia.

Affordable, Direct Flights

With flights as low as $100 and only 2–3 hours from most U.S. hubs, Mexico is the most accessible international manufacturing destination for American businesses.

Cultural Compatibility & Communication

Mexico offers a smoother cultural fit than many overseas markets. English is common in manufacturing sectors, reducing misunderstandings and speeding negotiations.

Border Infrastructure Built for Trade

The U.S.-Mexico border is optimized for cross-border commerce, with well-established trucking routes, ports, and customs systems that simplify logistics and reduce delays.

sUBMIT A SOURCING REQUEST UNDER 2 MINUTES

Verify your email and submit a sourcing request so we can quickly review your needs and start helping you find the right products or manufacturers.

Book A Call Now

Talk to a sourcing strategist and walk away with an action-ready checklist.

Case Study from Mexico

Explore a case study where the Importivity team helped a client source a manufacturer from Mexico.

Case Study: Importing $10M+ in Custom Ironwork from Monterrey, Mexico

How Importivity helped a Dallas-based home builder streamline cross-border sourcing and scale to 40+ containers a year of high-end custom metal products.

The Challenge

Quality · Cost · Lead Times

The Solution

Monterrey Partners

End-to-End Ops

The Results

Scale · Speed · Cost

Why It Worked

Nearshoring Advantages

Industries We Specialize in Within Mexico

Industries Where Mexico Sets the Global Standard

From automotive metals to consumer plastics, Mexico’s manufacturing base is diverse and growing. Importivity connects U.S. businesses with vetted factories in metals, plastics, electronics, and textiles—helping you cut costs, shorten lead times, and leverage USMCA trade advantages.

Plastics

Winner: Mexico (for nearshore automotive & consumer goods)

Mexico’s plastics sector is strong in automotive parts and consumer goods, benefiting from U.S. proximity and tariff-free trade.

China’s Edge

Complex molds and ultra-high-volume runs still favor China’s scale and tooling speed.

Metals

Winner: Mexico (for aerospace & automotive supply chains)

Mexico is a powerhouse for automotive and aerospace metals, supported by precision machining and tight integration with North American OEMs.

China’s Edge

Lower costs for commodity metals and massive supplier networks.

Electronics

Winner: China (for scale, but Mexico is emerging)

China remains the undisputed leader in electronics. However, Mexico is expanding in consumer electronics assembly, where shorter shipping times and reduced tariffs outweigh cost differences.

Mexico’s Edge

Best for brands prioritizing speed-to-market in North America.

Textiles

Winner: Vietnam (for fast fashion, but Mexico fills a niche)

Mexico specializes in niche apparel runs, technical wear, and rapid delivery cycles for U.S. buyers. While labor costs are higher than Vietnam, nearshore production cuts turnaround times dramatically.

Vietnam’s Edge

Best for cost-sensitive, high-volume fashion runs.

How These Resources Fit Into Your Strategy

Each of these resources can be used on its own but they’re most powerful when applied together as part of a streamlined sourcing process.

BOM Template

Use the BOM Template to organize your product specs.

RFQ Template

Follow with the RFQ Template to collect accurate supplier quotes.

Factory Visit Checklist

Visit suppliers using the Factory Visit Checklist.

Supplier Onboarding Checklist

Once you select a partner, implement the Supplier Onboarding Checklist.

Landed Cost Calculator

Use the Landed Cost Calculator to forecast true costs and finalize pricing.

Product Sourcing Guide

Current Tariffs on Mexico Imports

Update: 6:04 PM CST September 24th, 2025

25% Tariff Announced on Mexican (and Canadian) Goods

Effective: Mar 4, 2025

Scope varies by USMCA status

USMCA Carve-Out Window (Exemption Until Apr 2, 2025)

USMCA-compliant goods

Thru: Apr 2, 2025

90-Day Pause on Planned 30% Tariff for USMCA Goods

Announced: late Jul 2025

Duration: ~90 days

Importivity Product Sourcing Experts

Trusted partners in finding, vetting, and managing global manufacturers with full cost transparency.

The Team Behind Transparent Global Trade

Tanner Plante

Jordan Lewis

Courtney King

Lila Manroe

Frequently Asked Questions

If you need further assistance, feel free to reach out to our team!

Why should U.S. companies consider Mexico for manufacturing connections?

Mexico offers a unique blend of geographic proximity, cost savings, and trade advantages under the USMCA. For U.S. businesses, this means shorter lead times, lower freight costs, and tariff benefits compared to Asia. With a strong base in metals, plastics, electronics, and textiles, Mexico has become one of the most strategic alternatives to China for companies looking to diversify supply chains.

What industries are strongest for Mexico manufacturing?

Mexico excels in automotive metals, aerospace machining, consumer plastics, textiles, and electronics assembly. Its position as a nearshore hub means it can support both high-volume production and custom, niche manufacturing. Importivity specializes in helping clients identify the right factory connections within these industries while balancing cost, quality, and scalability.

Mexico excels in automotive metals, aerospace machining, consumer plastics, textiles, and electronics assembly. Its position as a nearshore hub means it can support both high-volume production and custom, niche manufacturing. Importivity specializes in helping clients identify the right factory connections within these industries while balancing cost, quality, and scalability.

How do tariffs affect manufacturing in Mexico?

As of September 2025, U.S. imports from Mexico face 25% tariffs on most goods unless they comply with USMCA rules of origin, which exempt qualifying products. Additionally, a 90-day moratorium on 30% tariff increases was recently extended, providing relief to many U.S. importers. Working with Importivity ensures your sourcing strategy leverages tariff-compliant factories and takes advantage of USMCA benefits.

How does nearshoring to Mexico compare to manufacturing in China or Vietnam?

Nearshoring to Mexico significantly reduces shipping time, logistics complexity, and communication barriers. While China still dominates in scale and advanced electronics, and Vietnam in low-cost textiles, Mexico provides faster delivery to U.S. markets, fewer cultural barriers, and strong trade protections. For many companies, Mexico represents the best balance between cost and convenience.

What are the challenges of working with manufacturers in Mexico?

The biggest challenges are slightly higher labor costs than Asia, limited raw materials (often imported from other countries), and occasional capacity constraints in high-demand industries. However, the benefits of shorter lead times, reduced logistics risk, and tariff savings often outweigh these challenges for U.S. companies.

How can Importivity help me connect with the right manufacturers in Mexico?

Importivity provides end-to-end support: sourcing vetted factories, managing supplier negotiations, ensuring compliance with USMCA, and coordinating inspections, logistics, and customs. We also leverage our long-standing factory partnerships (including “sister factories” in Mexico created to avoid tariffs) to give clients a direct advantage.

Still have questions?

Our team is happy to help! Visit our Help Center or contact us directly.