Mexico vs China Manufacturing

Discover whether Mexico’s nearshore speed or China’s global scale is the better fit for your products. We make the complexities simple, so you can focus on growth.

What does a Product Sourcing Company do?

When comparing Mexico vs China manufacturing, the decision often comes down to proximity versus scale. China remains the global powerhouse with unmatched supplier networks and advanced capabilities across nearly every industry. Mexico, however, has emerged as a nearshoring leader, offering shorter lead times, tariff-free trade with the U.S. under USMCA, and cost efficiencies for North American brands.

Labor Costs & Workforce

Vietnam’s lower wages give it a clear edge for labor-intensive industries such as textiles, footwear, and basic assembly, helping brands protect margins and launch products at a competitive cost. China, while more expensive, offers a massive and highly skilled workforce with decades of expertise in advanced manufacturing, making it the better choice when precision, consistency, and scalability matter most.

Winner: China

Despite wages rising in China, its workforce still delivers higher specialization and productivity per worker, particularly in plastics, electronics, and metals. For businesses needing advanced technical expertise, China remains strong.

Why choose Mexico anyway?

Mexico’s labor costs are competitive with China in many sectors, and lower in some regions. More importantly, time zone alignment with the U.S. and cultural compatibility create smoother collaboration. For industries like textiles and simpler assembly, Mexico’s workforce delivers excellent value.

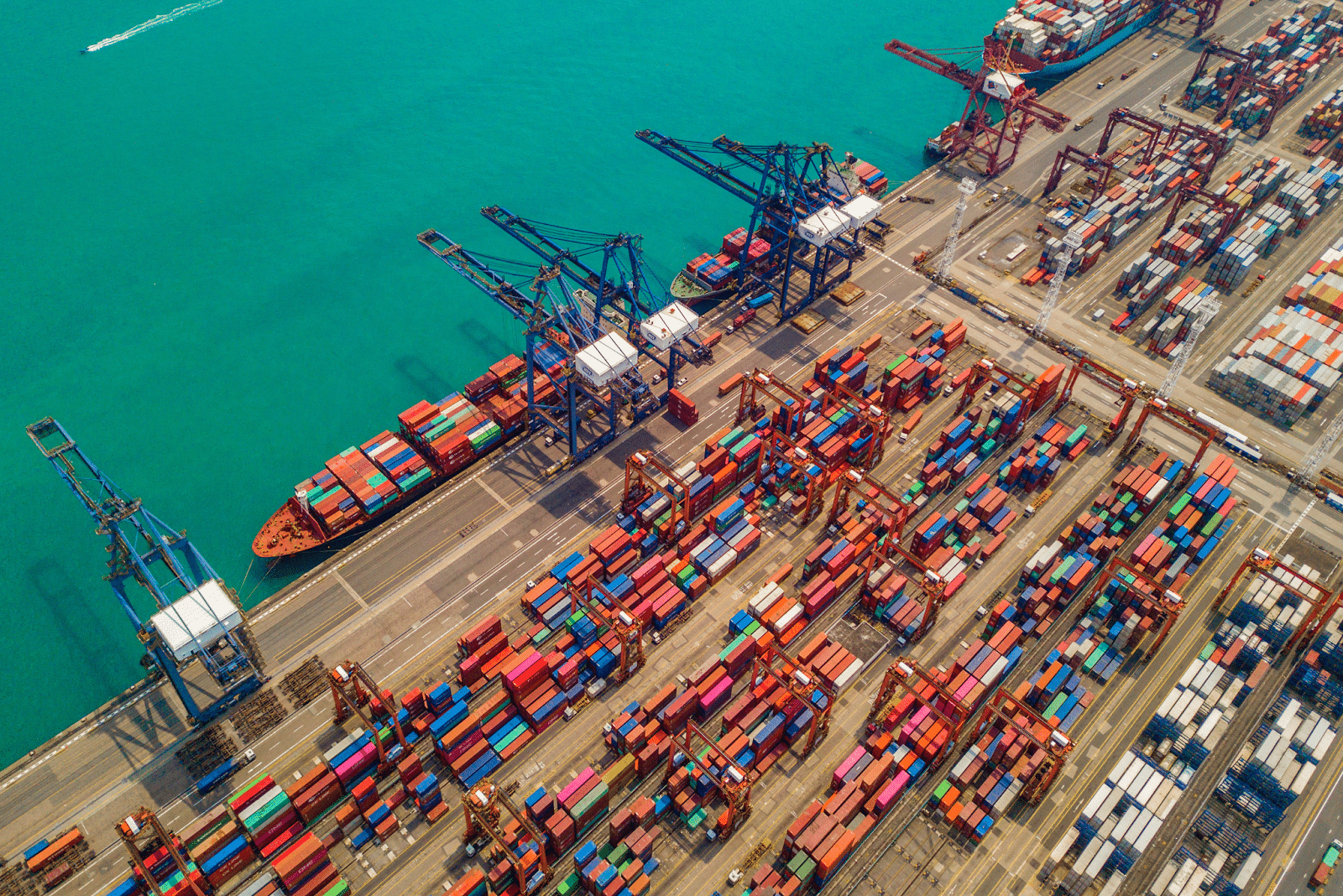

Supply Chain & Infrastructure

Infrastructure maturity determines how smoothly products move from factory to customer. China boasts the world’s most advanced manufacturing ecosystem, while Vietnam continues to expand with new industrial parks and foreign investment. Mexico offers reliable infrastructure with the added advantage of shorter cross-border logistics.

Winner: China

China’s scale in manufacturing clusters, raw material access, and export logistics is still the global benchmark. Shenzhen, Guangzhou, and Suzhou remain unrivaled hubs for electronics, plastics, and metals.

Why consider Mexico anyway?

Mexico’s infrastructure has advanced rapidly with major industrial parks near the U.S. border, upgraded ports, and robust trucking routes. While it cannot yet match China’s breadth, it offers faster cross-border shipping and a growing supplier base across industries like automotive, appliances, and consumer goods.

Tariffs & Trade Policy

Labor costs can make or break your sourcing strategy. Vietnam offers lower wages for labor-intensive industries like textiles, while China provides a more specialized and experienced workforce. Mexico sits in between, benefiting from affordable labor and geographic proximity to the U.S. market.

Winner: Mexico

Mexico benefits from USMCA (United States–Mexico–Canada Agreement), which allows tariff-free trade with the U.S.. This significantly reduces landed costs for American companies.

Why consider China anyway?

China’s products often face U.S. Section 301 tariffs, but businesses still choose China for scale, specialization, and supplier variety. For advanced sectors like electronics assembly and high-precision CNC machining, the added tariff costs may be offset by technical superiority.

Mexico vs China Industry Comparisons

See how Mexico’s nearshore advantages stack up against China’s global scale across plastics, metals, electronics, and textiles.

Plastics Manufacturing

Winner: China

China dominates in injection molding and plastics production, with advanced tooling and economies of scale.

Mexico’s Advantage

Great for smaller runs and custom plastics, where faster delivery to U.S. buyers adds value.

Metals & CNC Manufacturing

Winner: China

China has the depth and expertise in CNC machining, aluminum extrusion, and sheet metal fabrication that Mexico cannot yet match at scale.

Mexico’s Advantage

Mexico’s automotive sector expertise makes it highly competitive in certain stamping and metal assembly categories.

Electronics Assembly

Winner: China

China’s electronics hubs remain unmatched for components, speed, and integration.

Mexico’s Advantage

Growing strength in automotive electronics, consumer devices, and nearshore assembly, appealing to brands seeking tariff-free supply chains.

Textiles & Apparel

Winner: Mexico

Mexico leads in apparel and textile nearshoring, offering tariff-free access to the U.S. and shorter lead times.

China’s Advantage

Still ahead in technical textiles, luxury fabrics, and high-volume fast fashion.

Logistics & Shipping

Logistics can impact both costs and lead times. Mexico’s proximity allows fast ground transport into the U.S., while China and Vietnam depend heavily on maritime shipping. Vietnam offers shorter routes to Europe compared to China, but both face longer ocean transit than nearshore alternatives.

Winner: Mexico

Proximity is Mexico’s superpower. With trucking and rail networks directly connected to the U.S., shipping is measured in days, not weeks. This enables faster inventory turns and reduced shipping costs.

Why consider China anyway?

China’s long-distance shipping takes longer (typically 30–40 days by sea), but its volume discounts, established freight corridors, and robust export systems keep costs manageable. For companies that can forecast demand further out, this remains workable.

sUBMIT A SOURCING REQUEST UNDER 2 MINUTES

Verify your email and submit a sourcing request so we can quickly review your needs and start helping you find the right products or manufacturers.

Book A Call in less than 60 seconds

The Importivity Process

Importivity is not just another product sourcing company. Our process is built to remove uncertainty and protect margins at every stage. Here is how we make global sourcing predictable, transparent, and profitable:

Discovery

We start by defining product specifications, compliance requirements, target costs, and timelines. This step ensures we source the right factory from the start and align with your business goals.

1

Factory Vetting

Our team identifies, audits, and validates manufacturers from our global network. Unlike many sourcing companies that hand over a list of names, we confirm certifications, capacity, and reliability before you commit.

2

Sampling & Tooling

We oversee prototype development, mold and tooling creation, and pre-production validation. This stage is critical in plastics manufacturing, metal fabrication, and electronics assembly, where tooling costs and tolerances can make or break profitability.

3

Quality Assurance and Quality Control (QA/QC)

Importivity conducts inspections at every stage: pre-production, in-line, and final. This prevents quality drift, reduces rework, and ensures your products meet the standards of both your customers and regulators.

4

Compliance & Packaging

We manage testing, labeling, and certification for markets like the U.S. and EU. Whether it is RoHS for electronics, FDA for plastics, or labor compliance for textiles, our product sourcing services protect you from hidden liabilities.

5

Logistics

Our logistics team coordinates everything from factory floor to final delivery. We work with vetted freight forwarders and manage customs documentation so you avoid delays and hidden costs.

Lead Times & Scalability

Scaling production is often the deciding factor for global brands. China’s supplier density enables rapid scale at almost any volume, while Vietnam can be more agile for smaller runs. Mexico offers moderate scalability with the advantage of faster delivery into the U.S. market.

Winner: China

China still outperforms in massive scaling capabilities, supporting businesses with huge production needs across industries.

Why consider Mexico anyway?

Mexico delivers goods to the U.S. in a matter of days, enabling faster replenishment and lower shipping costs.

Sourcing Company Case Studies

Real examples of how our sourcing company delivers results across industries and markets.

Frequently Asked Questions

If you need further assistance, feel free to reach out to our team!

Is Mexico cheaper than China for manufacturing?

Mexico often has a lower total landed cost because of tariff-free trade under USMCA and shorter shipping distances. China can still be cheaper for high-volume, labor-intensive products due to economies of scale.

What are the main advantages of manufacturing in Mexico vs China?

Mexico’s biggest advantages are proximity to the U.S., faster lead times, and tariff-free trade. China offers unmatched supplier density, advanced capabilities, and scalability, making it ideal for complex products.

Which industries are best suited to Mexico vs China?

Mexico: Textiles, apparel, automotive components, consumer goods.

China: Plastics, metals, CNC machining, electronics, high-precision products.

How do shipping times compare between Mexico and China?

Mexico can deliver goods to the U.S. in a matter of days via trucking or rail, while sea freight from China typically takes 30–40 days.

How do tariffs affect Mexico vs China manufacturing?

Goods from Mexico enjoy duty-free status under USMCA. In contrast, many Chinese imports face U.S. Section 301 tariffs, which can add 10–25% to landed costs.

Should I move all production from China to Mexico?

Not always. Many businesses use a dual sourcing strategy: moving some production to Mexico for faster delivery and tariff savings, while keeping China for large-scale, technical manufacturing.

Is quality better in Mexico or China?

Both countries can deliver high-quality products, but China’s decades of experience in advanced manufacturing give it an edge in precision industries. Mexico delivers reliable quality in textiles and mid-complexity assembly, especially when serving the North American market.

Still have questions?

Our team is happy to help! Visit our Help Center or contact us directly.